Australia's fintech landscape has undergone a remarkable transformation over the past decade, evolving into a vibrant ecosystem characterized by innovation, competition, and substantial investment. The country has positioned itself as a global hub for financial technology, attracting a diverse array of startups and established players that leverage technology to enhance financial services. So lets check out the largest fintech companies in Australia with future growth projections as we approach 2025.

Overview of the Fintech Industry in Australia

The term "fintech," which combines "financial" and "technology," refers to companies that utilize technology to enhance, streamline, or automate financial services. In Australia, the fintech sector has witnessed significant growth, with the total market value soaring from approximately AU$250 million in 2015 to over AU$4 billion by 2021, marking an impressive trajectory that underscores the increasing reliance on digital financial solutions. According to the Fintech Australia Census, about 78% of fintech companies are now post-revenue, a notable increase from 70% in 2021, reflecting the sector's maturation and resilience in the face of economic challenges, including the COVID-19 pandemic.

Australia's fintech landscape is diverse, encompassing various subsectors such as payments, lending, wealth management, and insurtech. The payments sector remains the largest, with over 160 firms constituting roughly 20% of the overall fintech landscape, followed closely by lending and wealthtech, which account for 17% and 10%, respectively. This diversity is indicative of a robust ecosystem that fosters innovation and competition, enabling startups to thrive alongside traditional financial institutions.

Key Players in the Australian Fintech Space

Afterpay, a pioneer in the buy now, pay later (BNPL) segment, has emerged as one of the most recognizable names in the Australian fintech landscape. Founded in 2014, Afterpay allows consumers to make purchases and pay for them in installments, a model that has gained immense popularity among younger consumers. As of its acquisition by Block, Inc. (formerly Square) for approximately AU$39 billion, Afterpay's valuation underscores its significant impact on the global fintech scene. The company's innovative approach has not only disrupted traditional credit models but has also attracted a substantial user base, with millions of active customers in Australia and abroad.

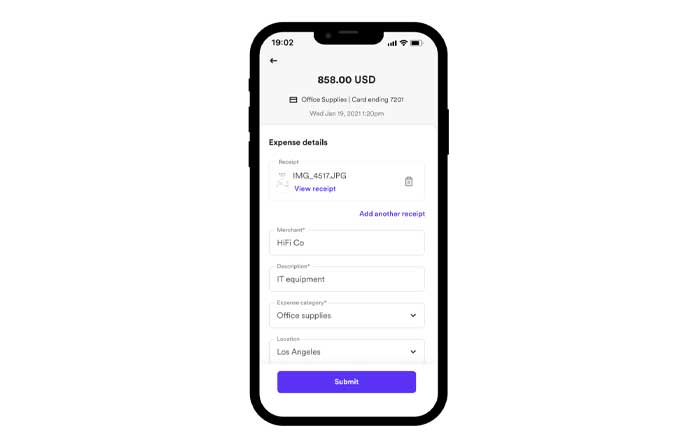

Airwallex, founded in 2015, is a cross-border payments platform that has gained recognition for its ability to facilitate international transactions seamlessly. Valued at around US$5.5 billion, Airwallex provides businesses with a suite of financial services, including payment processing, currency exchange, and expense management. The company's leadership, characterized by a strong focus on innovation and customer-centric solutions, has propelled its growth, positioning it as a key player in the fintech sector. With a global presence and a commitment to enhancing the efficiency of cross-border transactions, Airwallex is well-positioned for future expansion.

Judo Bank, a challenger bank focused on serving small and medium-sized enterprises (SMEs), has carved out a niche in the Australian banking landscape. Founded in 2016, Judo Bank has rapidly gained traction, with a valuation of approximately AU$1.4 billion. The bank's leadership emphasizes a relationship-driven approach, providing tailored financial solutions to underserved segments of the market. By leveraging technology to streamline lending processes, Judo Bank has positioned itself as a formidable competitor to traditional banks, offering SMEs access to the capital they need to grow and thrive.

Zip Co is another prominent player in the BNPL space, offering consumers flexible payment options for online and in-store purchases. Founded in 2013, Zip Co has expanded its services to include a variety of financial products, including personal loans and digital wallets. The company's innovative approach to consumer finance has garnered significant attention, and its strategic partnerships with retailers have facilitated rapid growth. With a focus on enhancing the customer experience and providing financial solutions that meet evolving consumer needs, Zip Co is poised for continued success in the coming years.

Australian Fintech Timeline

Zip Co

Founded as a Buy Now, Pay Later (BNPL) service, offering flexible payment options for online and in-store purchases.

Afterpay

Pioneered the BNPL segment in Australia, allowing consumers to make purchases and pay in installments.

Airwallex

Established as a cross-border payments platform, facilitating seamless international transactions for businesses.

Judo Bank

Launched as a challenger bank focused on serving small and medium-sized enterprises (SMEs) with tailored financial solutions.

Industry Growth

Australian fintech sector's total market value reaches over AU$4 billion, marking significant growth from AU$250 million in 2015.

Future Outlook

The total market value of fintech in Australia is expected to exceed AU$10 billion, driven by digital transformation and increasing consumer adoption.

Market Share and Financial Performance

As of 2023, the Australian fintech sector has experienced a surge in investment, with a reported five-fold increase in the number of fintech companies over the past five years. This growth has been fueled by a combination of factors, including a favorable regulatory environment, increasing consumer demand for digital financial services, and a culture of innovation that encourages startups to explore new business models. The total transaction value in the payments sector alone is projected to reach AU$135 billion by 2026, with an estimated 21 million users engaging with fintech services.

The competitive landscape is characterized by a mix of established players and emerging startups, each vying for market share in various segments. According to KPMG's Fintech Landscape report, payments remain the dominant sector, with over 160 firms actively participating. Lending follows closely, representing around 17% of the fintech landscape, while wealthtech and insurtech are also gaining traction as consumers seek innovative solutions for managing their finances and investments.

Leadership and Innovation

Leadership within Australia's fintech companies is often marked by a commitment to innovation and a deep understanding of customer needs. Many founders and executives come from diverse backgrounds, bringing expertise from finance, technology, and entrepreneurship. This blend of skills fosters a culture of agility and adaptability, allowing fintech firms to respond swiftly to market changes and consumer demands.

For instance, Sanjeev Kumar, Chief Product Officer at Zai, emphasizes the importance of regulatory support in driving innovation within the sector. He notes that proactive decision-making by regulators has created an environment conducive to launching new products and services, enabling fintech companies to thrive. This collaborative relationship between fintech firms and regulatory bodies has been instrumental in shaping the industry, fostering an ecosystem that encourages competition and innovation.

Future Growth Projections

Looking ahead to 2025, the Australian fintech sector is poised for continued growth, driven by several key trends and developments. The ongoing digital transformation of financial services, coupled with increasing consumer adoption of technology-driven solutions, is expected to propel the sector forward. Analysts predict that the total market value of fintech in Australia could exceed AU$10 billion by 2025, as more consumers and businesses embrace digital financial solutions.

Moreover, the regulatory landscape is likely to evolve further, with initiatives such as the Consumer Data Right (CDR) Bill paving the way for greater transparency and competition in the banking sector. This regulatory framework is expected to enhance the open banking ecosystem, enabling fintech companies to leverage data to deliver personalized financial services and improve customer experiences.

The payments sector will remain a focal point of growth, with innovations such as contactless payments, digital wallets, and blockchain technology reshaping the way consumers transact. Additionally, the BNPL segment is anticipated to continue its upward trajectory, as more consumers seek flexible payment options that align with their financial preferences.

Conclusion

Australia's fintech sector has emerged as a dynamic and influential player on the global stage, characterized by a diverse array of companies that are reshaping the financial landscape. With key players like Afterpay, Airwallex, Judo Bank, and Zip Co leading the charge, the industry is well-positioned for sustained growth and innovation. As the sector continues to mature, the interplay between technology, regulation, and consumer demand will shape the future of fintech in Australia, paving the way for new opportunities and challenges in the years to come. The commitment to fostering a collaborative ecosystem, coupled with a focus on customer-centric solutions, will be instrumental in driving the success of Australia's fintech companies as they navigate the evolving financial landscape.