As digital technologies permeate almost every aspect of daily life and business operations, digital literacy has emerged as a critical competency for organizations seeking to thrive in the modern economy. The convergence of technology and business strategies has fundamentally altered how companies operate, compete, and deliver value to customers. Digital literacy empowers individuals and organizations to harness the full potential of digital tools and platforms, enabling them to innovate, adapt to market changes swiftly, and make data-driven decisions that propel business growth. In the fintech sector, where technological innovation is disrupting traditional financial services, digital literacy is particularly crucial. It allows businesses to navigate the complexities of emerging technologies, comply with regulatory requirements, and address cybersecurity challenges effectively.

Understanding Digital Literacy

What is Digital Literacy?

Digital literacy refers to the ability to use information and communication technologies to find, evaluate, create, and communicate information, requiring both cognitive and technical skills. It involves a comprehensive understanding of digital tools and platforms, as well as the capacity to critically assess the reliability and validity of information accessed through digital means. Digital literacy encompasses a spectrum of skills, from basic computer operations to advanced competencies such as coding, data analytics, and understanding of artificial intelligence and machine learning algorithms. It also includes awareness of digital rights, privacy concerns, and ethical considerations in the digital environment.

As defined by the European Commission, digital literacy is not only about technical know-how but also involves critical thinking and the ability to engage in online communities and networks effectively. In the business context, digital literacy enables employees to perform their roles more efficiently, collaborate with colleagues globally, and contribute to innovation within the organization.

The Evolution of Digital Literacy in the Digital Age

The concept of digital literacy has evolved alongside technological advancements, expanding from basic computer literacy in the late 20th century to a multifaceted skill set required in the 21st-century digital economy. Initially, digital literacy focused on the ability to operate computers and navigate the internet. However, with the advent of smartphones, social media, cloud computing, and big data, the scope of digital literacy has broadened significantly.

Today, digital literacy includes understanding how to protect personal and organizational data, knowledge of digital marketing strategies, proficiency in using collaborative tools, and the ability to analyze and interpret large datasets. The rise of the Internet of Things (IoT), artificial intelligence, and blockchain technology further complicates the digital landscape, necessitating continuous learning and adaptation. As per McKinsey & Company, organizations that invest in building digital capabilities are better positioned to leverage these technologies for competitive advantage.

Digital Literacy as a Competitive Advantage

Enhancing Productivity and Efficiency

Digital literacy is instrumental in enhancing productivity and efficiency within organizations. Employees who are proficient in digital tools can automate repetitive tasks, reduce manual errors, and optimize processes. For instance, leveraging project management software allows teams to coordinate tasks effectively, track progress, and meet deadlines. Data analytics tools enable businesses to gain insights from vast amounts of data, informing strategic decisions and identifying market trends.

Moreover, digital literacy facilitates the adoption of innovative technologies such as robotic process automation (RPA) and artificial intelligence (AI), which can further streamline operations. By embracing these technologies, organizations can reallocate human resources to more strategic, value-added activities, thereby improving overall productivity. According to a report by Deloitte, digitally mature companies are more likely to achieve higher efficiency and cost savings.

Facilitating Innovation and Growth

Innovation is essential for business growth and sustainability in a competitive market. Digital literacy equips employees with the skills necessary to explore new technologies, develop innovative products and services, and improve customer experiences. For example, understanding user experience (UX) design principles can lead to the development of more user-friendly applications and platforms.

Digital literacy also fosters a culture of experimentation and agility within organizations. Employees who are comfortable with digital tools are more likely to embrace change, suggest improvements, and contribute to continuous innovation. This adaptability is crucial in industries where technological disruption is frequent. Companies that leverage digital literacy to drive innovation can differentiate themselves in the market, capture new opportunities, and expand their customer base.

Furthermore, digital literacy enables businesses to implement data-driven strategies. By analyzing customer data, organizations can personalize offerings, enhance marketing efforts, and improve customer retention. As noted by Forbes, data-driven companies are more likely to acquire and retain customers, ultimately leading to increased revenue and growth.

Digital Literacy and the Workforce

Upskilling and Reskilling Employees

The dynamic nature of the digital economy requires employees to continuously update their skills to remain relevant. Upskilling involves enhancing existing capabilities, while reskilling refers to learning new skills for different roles. Digital literacy is at the core of both processes, as it enables employees to adapt to new technologies and changing job requirements.

Organizations must invest in training programs that focus on digital competencies, such as data analytics, cybersecurity, and proficiency with specific software applications. E-learning platforms, workshops, and mentorship programs are effective methods for delivering such training. By upskilling and reskilling their workforce, companies can improve employee performance, foster innovation, and reduce the skills gap that often hinders digital transformation initiatives.

Additionally, investing in employee development contributes to higher job satisfaction and retention rates. Employees who feel supported in their professional growth are more likely to remain with the organization, reducing turnover costs. The World Economic Forum emphasizes the importance of lifelong learning in preparing the workforce for the future of work.

Leadership in the Digital Era

Effective leadership is crucial in guiding organizations through the complexities of the digital age. Leaders must possess a high level of digital literacy to understand the strategic implications of technology, make informed decisions, and drive digital transformation efforts. This includes being aware of emerging technologies, understanding how they can impact the business, and recognizing potential risks and opportunities.

Digital literacy in leadership also involves fostering a digital culture within the organization. Leaders must encourage innovation, support experimentation, and create an environment where employees feel comfortable adopting new technologies. By setting a clear vision for digital initiatives and leading by example, leaders can motivate their teams to embrace change and contribute to organizational goals.

Furthermore, digitally literate leaders are better equipped to engage with stakeholders, including customers, investors, and partners, who increasingly expect businesses to leverage digital capabilities. As highlighted by the Financial Times, leadership in the digital era requires a combination of strategic thinking, technological understanding, and the ability to inspire and manage change.

Digital Literacy in Fintech

Understanding Financial Technologies

The fintech industry is at the forefront of technological innovation, disrupting traditional financial services through the application of advanced technologies. Digital literacy is essential for professionals in this sector to comprehend and leverage financial technologies effectively. This includes understanding blockchain and distributed ledger technologies, which underpin cryptocurrencies and enable secure, transparent transactions.

Moreover, knowledge of machine learning and AI is critical for developing algorithms that power robo-advisors, fraud detection systems, and personalized financial services. Fintech professionals must also be proficient in data analytics to interpret financial data, assess risk, and make informed investment decisions. Familiarity with application programming interfaces (APIs) allows for the integration of services and collaboration with other platforms.

As fintech continues to evolve, staying abreast of technological advancements is imperative. Professionals who are digitally literate can innovate more effectively, create value for customers, and maintain a competitive edge in a rapidly changing industry.

Navigating Digital Financial Services

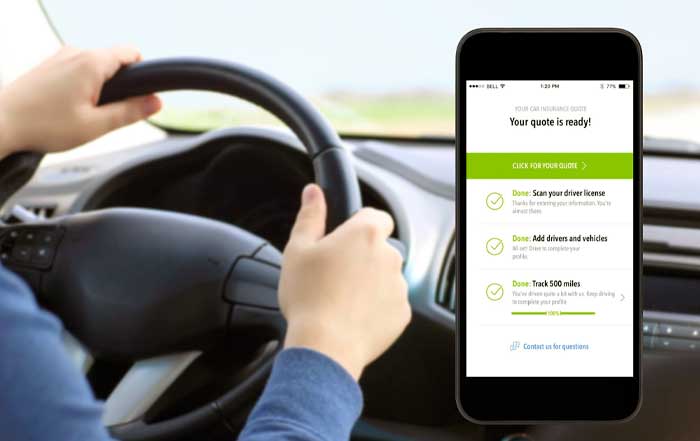

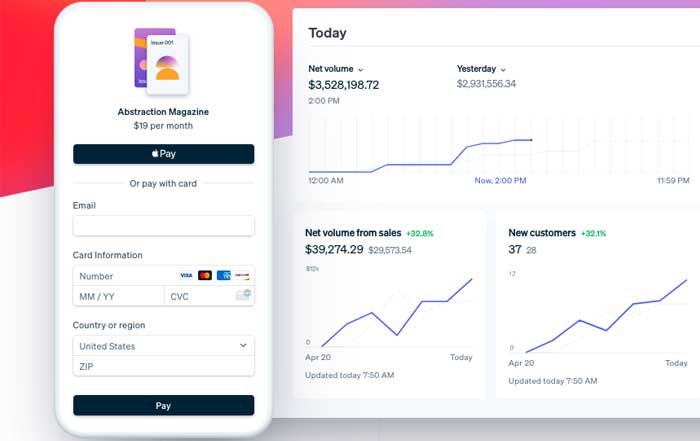

Digital literacy enables individuals and businesses to navigate digital financial services confidently and securely. Consumers with a high level of digital literacy can utilize online banking, mobile payment systems, and digital wallets efficiently, benefiting from the convenience and accessibility of these services. They are also better equipped to compare financial products, manage investments online, and make informed financial decisions.

For businesses, digital literacy allows for the adoption of fintech solutions that can streamline financial operations, such as automated accounting software, online invoicing systems, and integrated payment gateways. These tools can improve cash flow management, reduce errors, and provide real-time financial insights.

However, the complexity of digital financial services also presents challenges, including understanding terms and conditions, navigating user interfaces, and ensuring the security of transactions. Digital literacy helps users overcome these challenges by providing the skills needed to evaluate service providers critically, configure security settings appropriately, and recognize potential scams or fraudulent activities.

Security and Compliance

Cybersecurity Awareness

As organizations become more reliant on digital technologies, the risk of cyber threats increases significantly. Cybersecurity awareness is a critical component of digital literacy, involving knowledge of common threats such as phishing, malware, ransomware, and social engineering attacks. Employees must understand how to protect sensitive information, recognize suspicious activities, and respond appropriately to security incidents.

Implementing robust cybersecurity practices requires a digitally literate workforce that follows best practices, such as using strong passwords, updating software regularly, and adhering to the organization's security policies. Regular training and simulations can enhance cybersecurity awareness and reduce the likelihood of breaches caused by human error.

In the fintech sector, where financial data is highly sensitive, cybersecurity is of paramount importance. A security breach can lead to significant financial losses, legal penalties, and reputational damage. Therefore, digital literacy in cybersecurity is essential for maintaining customer trust and complying with regulatory requirements.

Regulatory Compliance

Compliance with regulations is a complex but essential aspect of operating in the digital and financial sectors. Digital literacy includes understanding relevant laws, standards, and guidelines, such as data protection regulations like the General Data Protection Regulation (GDPR) in the European Union or the Payment Card Industry Data Security Standard (PCI DSS).

Professionals must be able to interpret these regulations and implement appropriate measures to ensure compliance. This involves configuring systems to protect personal data, conducting regular audits, and maintaining detailed records. Failure to comply can result in significant fines and legal action.

Moreover, staying updated with regulatory changes is crucial, as laws governing digital technologies and financial services are continually evolving. Digital literacy enables organizations to adapt their practices proactively, avoiding compliance issues and demonstrating a commitment to ethical and lawful operations.

Barriers to Digital Literacy

Access to Technology

Access to technology is a fundamental prerequisite for developing digital literacy. However, disparities in access, often referred to as the digital divide, present significant barriers. Factors such as socioeconomic status, geographic location, and infrastructure availability can limit individuals' and organizations' ability to acquire the necessary hardware, software, and internet connectivity.

For businesses in developing regions or rural areas, limited access can impede efforts to modernize operations and compete in the global market. Addressing this barrier requires investment in infrastructure, affordable technology solutions, and policies that promote equitable access. Initiatives by governments and organizations, such as providing subsidized devices or expanding broadband networks, are critical in bridging the digital divide.

Education and Training Gaps

Education systems and training programs may not always align with the rapidly changing demands of the digital economy. Traditional curricula may lack emphasis on digital skills, leaving graduates unprepared for the workforce. Additionally, existing employees may not receive adequate training to keep pace with technological advancements.

Organizations may face challenges in identifying appropriate training resources or may lack the internal expertise to develop effective programs. This gap can hinder digital transformation efforts and limit innovation. Collaboration between educational institutions, industry, and government can help align educational outcomes with market needs. Programs that integrate practical digital skills, internships, and continuous professional development are essential for building a digitally literate workforce.

Furthermore, individual attitudes towards learning new technologies can be a barrier. Resistance to change, fear of obsolescence, or lack of confidence can prevent individuals from engaging in digital literacy initiatives. Creating supportive learning environments and highlighting the benefits of digital proficiency can encourage participation and overcome these challenges.

Digital Literacy Quiz

What is digital literacy?

Which is NOT a component of digital literacy?

What is a key benefit of digital literacy in business?

Quiz Complete!

Your score:0/3

Strategies to Enhance Digital Literacy

Corporate Training Programs

Implementing comprehensive corporate training programs is a strategic approach to enhancing digital literacy within organizations. These programs should be tailored to the specific needs of the business and the roles of employees. Key elements include:

Assessment of Current Skills: Identifying existing skill levels and gaps to design targeted training interventions.

Customized Learning Paths: Developing modules that address the required competencies, from basic digital skills to advanced technical expertise.

Blended Learning Methods: Combining online courses, workshops, mentoring, and hands-on projects to accommodate different learning styles.

Continuous Learning Culture: Encouraging ongoing development through access to resources, time allocated for learning, and recognition of achievements.

By investing in employee development, organizations can improve performance, foster innovation, and enhance their ability to adapt to technological changes. Additionally, such programs can improve employee engagement and loyalty, contributing to a positive organizational culture.

Collaboration with Educational Institutions

Partnering with educational institutions offers several benefits for businesses seeking to enhance digital literacy. These collaborations can include:

Curriculum Development: Working with educators to develop courses that reflect industry needs, ensuring that graduates possess relevant skills.

Research Partnerships: Engaging in joint research projects that explore emerging technologies and innovative applications.

Internship and Apprenticeship Programs: Providing practical experience for students, which can also serve as a talent pipeline for the organization.

Guest Lectures and Workshops: Sharing industry expertise with students, enhancing their understanding of real-world applications.

Such partnerships can help bridge the gap between academic learning and industry requirements, fostering a workforce that is better prepared for the challenges of the digital economy. They also allow businesses to influence educational outcomes and stay connected with the latest academic research and trends.

Government and Industry Initiatives

Government policies and industry initiatives play a significant role in promoting digital literacy. Programs that provide funding for training, tax incentives for technology investments, and support for small and medium-sized enterprises (SMEs) can encourage organizations to prioritize digital literacy.

Industry associations can develop standards, share best practices, and offer certification programs that recognize digital competencies. Collaboration between government, industry, and educational institutions can create a cohesive ecosystem that supports digital literacy development at all levels.

Case Studies

Successful Implementation of Digital Literacy Programs

Company A's Digital Transformation

Company A, a multinational corporation in the retail sector, embarked on a digital transformation journey to enhance customer experiences and streamline operations. Recognizing that digital literacy was a cornerstone of this initiative, the company launched a global training program targeting all levels of the organization.

The program included:

Executive Leadership Workshops: Focusing on strategic understanding of digital technologies and their impact on business models.

Employee Training Modules: Covering topics such as data analytics, digital marketing, cybersecurity, and use of collaborative tools.

Innovation Labs: Providing spaces for employees to experiment with new technologies and develop innovative solutions.

As a result of these efforts, Company A achieved significant improvements in operational efficiency, customer engagement, and revenue growth. The company introduced a successful e-commerce platform, personalized marketing campaigns, and optimized supply chain management using data analytics. The digital literacy program was instrumental in fostering a culture of innovation and agility.

Fintech Startup B's Employee Training

Fintech Startup B, specializing in peer-to-peer lending, recognized that its success depended on the technical expertise of its team. The startup implemented a continuous learning program focused on advanced digital skills, including:

Coding Bootcamps: Intensive training sessions on programming languages relevant to their platform development.

Cybersecurity Certifications: Ensuring all team members understood security protocols and compliance requirements.

Industry Conferences and Workshops: Encouraging attendance at events to stay updated on emerging trends and network with industry peers.

The investment in digital literacy enabled Startup B to develop a robust, secure platform that gained rapid market acceptance. Their ability to innovate quickly and adapt to regulatory changes positioned them as a leader in their niche. The company's commitment to employee development also attracted top talent, further strengthening their competitive advantage.

Knowledge is Your Advantage

Digital literacy is a fundamental imperative for businesses and professionals in today's technology-driven world. It serves as a catalyst for innovation, efficiency, and competitive advantage, enabling organizations to navigate the complexities of the digital landscape effectively. In the business sector, digital literacy empowers employees to optimize processes, make data-driven decisions, and contribute to strategic objectives. In fintech, it is essential for understanding and leveraging advanced technologies that are reshaping financial services.

Organizations must proactively address the barriers to digital literacy by investing in training, fostering a culture of continuous learning, and collaborating with educational institutions and industry partners. By doing so, they can build a workforce that is agile, innovative, and capable of driving growth in the digital economy.

As the digital landscape continues to evolve, the importance of digital literacy will only intensify. Businesses that recognize this and act decisively to enhance their digital capabilities will be better positioned to seize new opportunities, overcome challenges, and achieve sustained success in the years to come.