Businesses are recognizing the value of big data to remain competitive and innovative as essentially, big data refers to the voluminous, complex data sets that traditional data-processing application software struggles to handle efficiently. To offer context on the scale, the International Data Corporation (IDC) reported, “The Global Datasphere will grow from 33 zettabytes in 2018 to 175 zettabytes by 2025,” illustrating the rapid escalation in data creation and storage. On a parallel note, projections from Statista estimate that the global volume of data will reach 180 zettabytes by the same year, while Arcserve, a data protection company, speculates a potential 200 zettabytes by 2025.

This explosion of data has been fueled by the expansion of internet usage, digital transactions, and interconnected devices. Google, for example, continues to dominate the search engine landscape, holding approximately 92% of the global market share as of 2024. With 5.44 billion active internet users worldwide, it is estimated that close to 4.97 billion of these individuals rely on Google for their online searches, showcasing the vast amount of data flowing through its platforms. Similarly, Amazon’s role in e-commerce remains a significant force, with retail sales in 2023 totaling $444.76 billion and expected to increase to $540.29 billion by 2025, further contributing to the massive amounts of data generated by digital commerce,

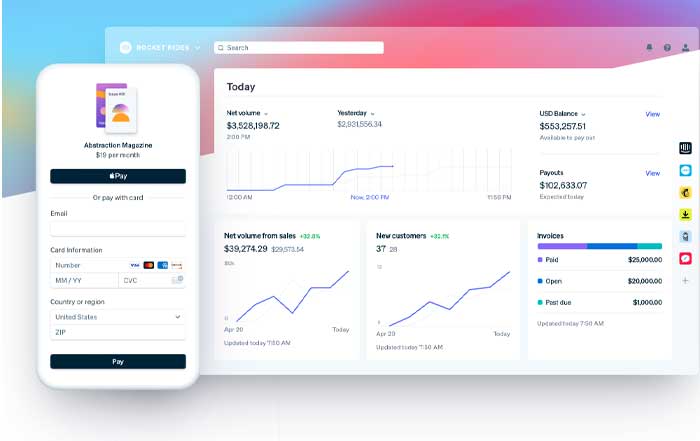

However, simply accumulating data is not enough. The complexity of such vast data sets, combined with the rapid speed of their generation, presents unique challenges. Companies must navigate issues such as false discovery rates and statistical anomalies that can arise from data with excessive complexity. To truly leverage big data, businesses need to adopt strategic approaches that not only manage but also extract actionable insights from this wealth of information. This article delves into five key strategies businesses can adopt to thrive in the era of big data. By 2025, Amazon Web Services (AWS), the cloud computing division of Amazon, is projected to remain the largest player in the cloud services market. With its extensive global infrastructure, AWS is expected to control over 30% of the global cloud market share, continuing its dominance over competitors like Microsoft Azure , Alibaba Cloud and Google Cloud. The division's revenue could surpass $150 billion, driven by demand for cloud storage, machine learning, and artificial intelligence services. AWS will continue expanding its data centers worldwide, offering scalable cloud solutions that serve enterprises, governments, and startups in various industries across the globe.

Proactivity and Innovation in Data Utilization

The ability to survive and thrive in the era of big data requires businesses to adopt a proactive and innovative approach toward how they gather and use data. No longer can companies rely solely on traditional data collection methods, such as customer feedback forms or basic surveys, to understand their audience. In this new data-driven world, businesses must tap into unconventional sources of data, ranging from social media interactions to tracking users' online behaviors across various platforms.

Social media, for instance, offers a treasure trove of real-time information that allows companies to gain deeper insights into customer preferences and emerging market trends. A retail company, for example, might analyze social media conversations to identify popular products or new fashion trends among consumers. By utilizing these data points, the company could tailor its marketing strategies, offering personalized promotions and creating a more engaging shopping experience for customers. Additionally, the insights gathered from social media can inform product development, helping businesses anticipate customer needs and preferences more effectively.

Similarly, financial institutions can utilize data on online behaviors to identify potential clients and develop targeted marketing efforts. Rather than relying on broad, traditional advertising campaigns, banks and investment firms can create customized offers and services based on individual customer profiles, such as financial habits, investment goals, and risk tolerance. This level of personalization not only enhances customer satisfaction but also gives companies a competitive edge in a crowded market.

By thinking outside the box and utilizing unconventional data sources, businesses can better understand their target demographic, drive customer engagement, and maintain their competitive advantage in an increasingly complex marketplace.

Data Organization: The Backbone of Big Data Success

While gathering vast amounts of data is essential, it is equally important to prioritize data organization. Many companies fall into the trap of accumulating data without a clear strategy for how to store, manage, and, most importantly, use it effectively. When data is not properly organized, it can result in "data silos," where information is stored in isolated pockets across various departments, making it difficult to extract meaningful insights or share valuable data between teams.

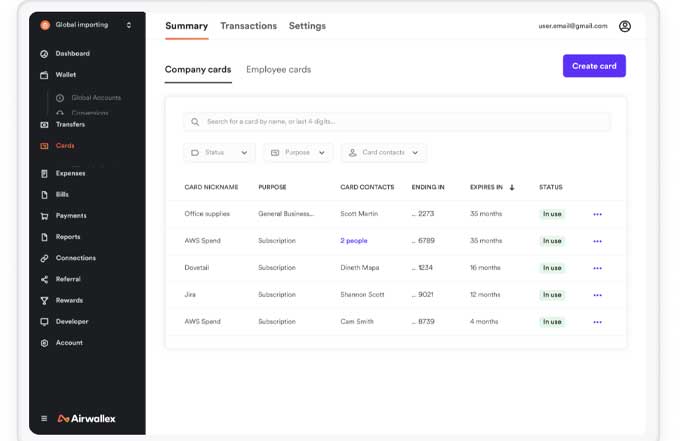

To overcome this challenge, businesses need to implement comprehensive data management strategies that focus on integrating data from multiple sources and ensuring it is easily accessible. This often involves utilizing data lakes or data warehouses, which allow organizations to store structured and unstructured data in a centralized repository. By breaking down data silos and ensuring that information flows seamlessly across departments, businesses can gain a holistic view of their operations, customer behaviors, and market trends.

Moreover, a well-organized data infrastructure allows companies to perform advanced analytics, enabling them to identify patterns, correlations, and trends that may have otherwise gone unnoticed. Whether it’s predicting future sales, optimizing supply chains, or enhancing customer service, an organized data system ensures that businesses can make data-driven decisions efficiently. In contrast, poorly managed data results in missed opportunities, delayed decision-making, and a lack of agility in responding to market changes.

Focusing on the integration and organization of data is critical for any company seeking to unlock the full potential of big data. By ensuring that data is accessible, organized, and readily available for analysis, companies can gain valuable insights that help drive growth, innovation, and competitive advantage.

5 Key Strategies for Thriving in the Big Data Era

Investing in Skilled Personnel: The Human Element of Big Data

The complexities of managing and analyzing big data require more than just sophisticated technology; businesses must invest in developing a skilled workforce that is equipped to handle the unique challenges of this data-driven world. Data science, machine learning, and artificial intelligence are just a few areas where businesses need employees with specialized expertise to interpret large quantities of data and translate those insights into actionable strategies.

The demand for skilled data analysts, data scientists, and machine learning engineers is growing rapidly as companies across all industries recognize the value of big data in driving business growth. Employees must be trained not only to gather and organize data but also to analyze and visualize it in a way that informs decision-making. In addition, data specialists need to work in close collaboration with other departments, such as marketing, sales, and operations, to ensure that data insights are aligned with business goals.

Training employees to handle big data should be a multidisciplinary effort, where individuals from various parts of the organization come together to analyze data from different perspectives. This collaborative approach allows businesses to uncover more nuanced insights and develop comprehensive strategies that address multiple aspects of the business. Furthermore, as technology continues to evolve, employees must be encouraged to stay updated on the latest advancements in data analytics, artificial intelligence, and machine learning to remain competitive.

In short, companies that prioritize the development of a skilled workforce will be better equipped to leverage big data effectively. By investing in training and fostering collaboration across departments, businesses can maximize the value of their data and make more informed decisions that drive success.

Embracing Creativity and Innovation in Big Data Strategies

One of the most critical aspects of thriving in the big data era is creativity. In a landscape where nearly every company has access to vast amounts of data, the true differentiator lies in how creatively businesses use that data to stand out from the competition. Creativity is not just about thinking outside the box but also about developing innovative strategies and solutions that harness the full power of big data.

For example, companies can use data to create predictive models that anticipate customer needs and behaviors. In the automotive industry, predictive maintenance systems can analyze data from vehicle sensors to identify potential issues before they lead to breakdowns. This allows companies to reduce downtime, minimize repair costs, and improve customer satisfaction by providing proactive maintenance services. Similarly, in the financial sector, data can be used to develop personalized investment portfolios tailored to an individual's risk tolerance, financial goals, and market conditions.

Creativity also extends to how companies approach new product development, marketing strategies, and customer experiences. By leveraging data insights, businesses can develop new products that address emerging trends and unmet customer needs. Moreover, creative data strategies can help companies refine their marketing campaigns, ensuring they resonate with the right audience at the right time. This level of personalization not only enhances customer loyalty but also strengthens brand identity in an increasingly competitive marketplace.

Businesses that are unafraid to embrace creativity and innovation will find themselves well-positioned to capitalize on the opportunities presented by big data. By developing creative strategies and leveraging data in novel ways, companies can differentiate themselves from competitors, improve operational efficiency, and drive business growth.

Preparing for the Future of Big Data

As the world continues to generate data at an unprecedented rate, the importance of big data will only continue to grow. Companies that are able to effectively manage and harness big data will be better positioned to make informed decisions, enhance customer experiences, and stay ahead of the competition. The future of big data promises even more opportunities for businesses to innovate, optimize operations, and create personalized experiences for their customers.

Looking ahead, advancements in artificial intelligence, machine learning, and cloud computing will likely drive further innovation in how businesses collect, store, and analyze data. For instance, AI-powered algorithms will enable companies to process data more efficiently and uncover insights that were previously unattainable through manual analysis. Cloud-based platforms will make it easier for organizations to scale their data infrastructure, allowing them to handle larger volumes of data without the need for significant on-premise investments.

Moreover, as data privacy and security become increasingly important, companies will need to adopt more robust data governance policies to protect customer information while ensuring compliance with evolving regulations. Businesses that can strike the right balance between leveraging data for growth and maintaining customer trust will be the ones that succeed in this data-driven future.

In conclusion, the era of big data presents both challenges and opportunities for businesses across industries. By being proactive and unconventional in their approach to data collection, focusing on data organization, investing in skilled personnel, and embracing creativity, companies can harness the power of big data to gain a competitive edge. As the world continues to generate more data, the ability to adapt and innovate will be crucial for businesses looking to thrive in the future. The companies that are prepared to embrace this data revolution will find themselves at the forefront of their industries, leading the way in innovation and growth.