The financial technology (fintech) sector has experienced unprecedented growth over the past decade, revolutionizing how consumers and businesses interact with financial services. As of 2024, the fintech market in the United States is projected to reach $520 billion by 2030, driven by innovation, consumer demand, and the ongoing digitization of financial services. This article delves into the ten largest fintech companies in the U.S., examining their market share, revenue, profit, number of employees, leadership, services, products, historical context, and future growth projections through 2025.

1. Stripe

Market Share and Valuation

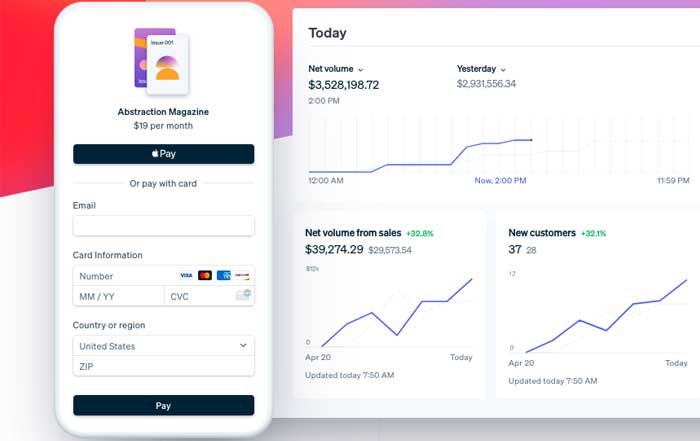

As of March 2024, Stripe leads the U.S. fintech landscape with a staggering market valuation of $65 billion. The company has established itself as a dominant player in the online payment processing sector, catering to millions of businesses worldwide.

Revenue and Profit

In 2023, Stripe reported revenues exceeding $7 billion, reflecting a robust growth trajectory fueled by the increasing shift towards e-commerce and digital transactions. The company has not yet disclosed its profit margins publicly, but its growth indicates a strong financial position.

Number of Employees and Leadership

Stripe employs approximately 6,000 individuals, led by co-founders Patrick and John Collison, who have been instrumental in driving the company's vision of simplifying online payments for businesses of all sizes.

Services and Products

Stripe offers a comprehensive suite of products, including payment processing, billing, fraud prevention, and financial management tools. Its API-driven approach allows businesses to integrate payment solutions seamlessly into their platforms.

History and Future Growth Projections

Founded in 2010, Stripe has rapidly expanded its services globally, capitalizing on the growing demand for digital payment solutions. With projections indicating continued growth, the company is expected to maintain its leadership position in the fintech sector through 2025 and beyond.

2. PayPal

Market Share and Valuation

PayPal, a pioneer in digital payments, boasts a market valuation of approximately $90 billion as of 2024. The company has maintained a significant share of the online payment market, serving over 400 million active accounts globally.

Revenue and Profit

In 2023, PayPal generated revenues of around $30 billion, with a net profit margin of approximately 17%. The company's diverse revenue streams, including transaction fees and value-added services, contribute to its financial stability.

Number of Employees and Leadership

With a workforce of around 30,000 employees, PayPal is led by CEO Dan Schulman, who has emphasized the importance of innovation and customer experience in driving the company's growth.

Services and Products

PayPal's offerings include online payment processing, mobile payments, and peer-to-peer transfer services through its Venmo platform. The company has also expanded into cryptocurrency trading, allowing users to buy, sell, and hold digital currencies.

History and Future Growth Projections

Founded in 1998, PayPal has evolved from a simple payment platform to a comprehensive financial services provider. As the fintech landscape continues to evolve, PayPal is projected to grow its market share, particularly in emerging markets, by 2025.

3. Square (now Block, Inc.)

Market Share and Valuation

Square, rebranded as Block, Inc., holds a market valuation of approximately $37 billion as of 2024. The company has carved out a niche in the small business payment processing sector, providing accessible financial solutions to merchants.

Revenue and Profit

In 2023, Block, Inc. reported revenues of $18 billion, with a net profit margin of around 5%. The company's focus on small businesses has allowed it to capture a significant share of the market.

Number of Employees and Leadership

Block employs around 7,500 individuals, with co-founder Jack Dorsey serving as CEO. Dorsey's vision for Block emphasizes the integration of technology and finance to create innovative solutions.

Services and Products

Block offers a range of services, including point-of-sale systems, online payment processing, and financial management tools for small businesses. The company has also ventured into cryptocurrency through its Cash App platform.

History and Future Growth Projections

Founded in 2009, Block has rapidly expanded its services and product offerings, positioning itself as a leader in the fintech space. With projections indicating continued growth, the company is expected to thrive in the evolving financial landscape through 2025.

4. Robinhood

Market Share and Valuation

Robinhood has transformed the investment landscape with its commission-free trading model, achieving a market valuation of approximately $11 billion as of 2024. The company has attracted millions of users seeking to invest in stocks and cryptocurrencies without traditional brokerage fees.

Revenue and Profit

In 2023, Robinhood generated revenues of around $1.8 billion, primarily through payment for order flow and premium subscription services. The company's innovative approach has allowed it to maintain a competitive edge in the market.

Number of Employees and Leadership

Robinhood employs around 3,000 individuals, led by CEO Vlad Tenev, who co-founded the company in 2013 with Baiju Bhatt. Their vision was to democratize finance for all.

Services and Products

Robinhood offers a user-friendly mobile app that allows users to trade stocks, options, ETFs, and cryptocurrencies. The company has also introduced features such as fractional shares and educational resources to enhance the user experience.

History and Future Growth Projections

Since its inception, Robinhood has disrupted traditional brokerage models, appealing to a younger demographic of investors. As the company continues to innovate and expand its offerings, it is projected to grow significantly through 2025.

5. Chime

Market Share and Valuation

Chime, a leading neobank, has a market valuation of approximately $25 billion as of 2024. The company has gained traction by offering fee-free banking services to consumers, particularly targeting the underbanked population.

Revenue and Profit

In 2023, Chime reported revenues of around $1 billion, primarily generated through interchange fees and interest on customer deposits. The company's business model focuses on providing accessible financial services without traditional banking fees.

Number of Employees and Leadership

Chime employs approximately 1,500 individuals, with co-founder Chris Britt serving as CEO. Britt's leadership has been pivotal in driving Chime's mission to provide financial inclusion.

Services and Products

Chime offers a range of banking services, including checking and savings accounts, direct deposit, and automated savings tools. The company's mobile app provides users with a seamless banking experience.

History and Future Growth Projections

Founded in 2013, Chime has rapidly grown its customer base, amassing over 13 million users by 2024. With a strong focus on customer experience and financial literacy, Chime is well-positioned for continued growth through 2025.

Top 10 US Fintech Companies Timeline

6. SoFi

Market Share and Valuation

SoFi, short for Social Finance, has a market valuation of approximately $10 billion as of 2024. The company has established itself as a comprehensive financial services platform, offering a wide range of products to consumers.

Revenue and Profit

In 2023, SoFi generated revenues of around $1.5 billion, with a focus on personal loans, student loan refinancing, and investment services. The company's diverse revenue streams contribute to its financial health.

Number of Employees and Leadership

SoFi employs around 3,000 individuals, led by CEO Anthony Noto, who has emphasized the importance of innovation and customer-centric services in driving growth.

Services and Products

SoFi offers a variety of financial products, including personal loans, mortgages, investment services, and insurance. The company's mobile app provides users with a holistic view of their financial health.

History and Future Growth Projections

Founded in 2011, SoFi has evolved from a student loan refinancing platform to a comprehensive financial services provider. With projections indicating continued growth, the company is expected to expand its market presence through 2025.

7. Plaid

Market Share and Valuation

Plaid, a leading financial data aggregator, has a market valuation of approximately $13 billion as of 2024. The company plays a crucial role in connecting consumers' bank accounts to various fintech applications.

Revenue and Profit

In 2023, Plaid reported revenues of around $500 million, primarily generated through subscription fees from developers and financial institutions. The company's unique position in the fintech ecosystem contributes to its financial success.

Number of Employees and Leadership

Plaid employs around 1,000 individuals, with co-founder and CEO Zach Perret at the helm. Perret's vision has been instrumental in driving Plaid's growth and innovation.

Services and Products

Plaid offers a suite of APIs that enable developers to connect their applications to users' bank accounts securely. The company's services are widely used by various fintech applications, including Venmo and Robinhood.

History and Future Growth Projections

Founded in 2013, Plaid has rapidly expanded its services and partnerships, positioning itself as a key player in the fintech ecosystem. With increasing demand for financial data connectivity, Plaid is projected to experience significant growth through 2025.

8. Affirm

Market Share and Valuation

Affirm, a leading buy now, pay later (BNPL) provider, has a market valuation of approximately $10 billion as of 2024. The company has gained popularity by offering consumers flexible payment options for online purchases.

Revenue and Profit

In 2023, Affirm generated revenues of around $1.5 billion, primarily through merchant fees and interest on consumer loans. The company's innovative approach to financing has allowed it to capture a significant share of the BNPL market.

Number of Employees and Leadership

Affirm employs around 1,500 individuals, with co-founder Max Levchin serving as CEO. Levchin's leadership has been pivotal in shaping Affirm's vision and growth strategy.

Services and Products

Affirm offers a range of financing solutions, allowing consumers to make purchases and pay over time. The company's partnerships with various retailers enhance its market reach.

History and Future Growth Projections

Founded in 2012, Affirm has rapidly grown its user base, capitalizing on the increasing demand for flexible payment options. With projections indicating continued growth, the company is expected to thrive in the evolving fintech landscape through 2025.

9. Coinbase

Market Share and Valuation

Coinbase, a leading cryptocurrency exchange, has a market valuation of approximately $10 billion as of 2024. The company has played a significant role in popularizing cryptocurrency trading among retail investors.

Revenue and Profit

In 2023, Coinbase generated revenues of around $5 billion, primarily through transaction fees on cryptocurrency trades. The company's position as a leading exchange has contributed to its financial success.

Number of Employees and Leadership

Coinbase employs around 3,000 individuals, with co-founder Brian Armstrong serving as CEO. Armstrong's vision has been instrumental in driving Coinbase's growth and innovation.

Services and Products

Coinbase offers a user-friendly platform for buying, selling, and trading various cryptocurrencies. The company has also introduced features such as staking and educational resources to enhance the user experience.

History and Future Growth Projections

Founded in 2012, Coinbase has rapidly expanded its services and user base, becoming a household name in the cryptocurrency space. With increasing interest in digital assets, Coinbase is projected to continue its growth trajectory through 2025.

10. Intuit

Market Share and Valuation

Intuit, the parent company of TurboTax and QuickBooks, has a market valuation of approximately $120 billion as of 2024. The company has established itself as a leader in financial software solutions for consumers and small businesses.

Revenue and Profit

In 2023, Intuit reported revenues of around $14 billion, with a net profit margin of approximately 20%. The company's diverse product offerings contribute to its strong financial performance.

Number of Employees and Leadership

Intuit employs around 10,000 individuals, with CEO Sasan Goodarzi leading the company. Goodarzi's focus on innovation has been pivotal in driving Intuit's growth.

Services and Products

Intuit offers a range of financial software solutions, including tax preparation, accounting, and personal finance management tools. The company's products are widely used by consumers and businesses alike.

History and Future Growth Projections

Founded in 1983, Intuit has evolved from a tax software provider to a comprehensive financial services company. With projections indicating continued growth, Intuit is expected to maintain its leadership position in the fintech sector through 2025.

Conclusion

The fintech landscape in the United States is characterized by rapid growth and innovation, with the top ten companies leading the charge in transforming financial services. As consumer demand for digital solutions continues to rise, these companies are well-positioned to capitalize on emerging opportunities, driving further growth and reshaping the financial services industry. With projections indicating a bright future for fintech, the next few years will be crucial in determining how these companies adapt and thrive in an ever-evolving market.