The fintech (financial technology) revolution has been one of the most significant developments in the global business environment in recent years. As we move toward 2025, fintech continues to reshape how companies and individuals engage with financial services. The evolution of technology-driven financial services has brought unprecedented change, offering innovative solutions, enhancing efficiency, and democratizing access to financial tools for consumers and businesses alike. From payments and lending to insurance, asset management, and beyond, fintech is playing a pivotal role in transforming the landscape of global business.

The Growth of Fintech: A Brief Overview

The growth of fintech can be traced back to the early 2000s when the digitalization of financial services started gaining momentum. However, the real explosion occurred in the past decade, driven by the rise of smartphones, improved internet penetration, and advances in data processing and artificial intelligence (AI). By 2025, the global fintech market is projected to reach unprecedented levels, with investments in the sector continuing to soar. This growth is not limited to developed economies, as emerging markets are also seeing a fintech boom, driven by mobile payments and digital banking solutions.

Fintech's rapid rise can be attributed to its ability to address the inefficiencies of traditional banking and financial systems. Historically, the financial sector has been plagued by slow processes, high costs, and limited accessibility, particularly for underserved populations. Fintech companies, with their agile and tech-driven approach, have disrupted traditional financial models by offering faster, cheaper, and more transparent services, ultimately leading to better customer experiences and improved financial inclusion.

Fintech’s Impact on Global Payments

One of the most visible ways fintech is changing the global business landscape is through its impact on payments. Traditional payment methods, such as wire transfers and credit cards, are often costly, slow, and restricted by geographic boundaries. Fintech solutions, particularly in the area of digital payments, have introduced a new era of speed, convenience, and global reach.

Digital wallets and mobile payment platforms, such as PayPal, Venmo, and China’s WeChat Pay, have revolutionized the way businesses and consumers transact. These platforms have made cross-border payments easier, reducing reliance on traditional banking systems and minimizing transaction fees. Moreover, the integration of blockchain technology in fintech has paved the way for even more secure, transparent, and fast payments. Cryptocurrencies like Bitcoin and stablecoins pegged to fiat currencies have become increasingly popular for international transactions, allowing businesses to bypass conventional payment channels and reduce the cost of sending money across borders.

In 2025, the adoption of digital currencies by both businesses and governments is expected to accelerate. Central bank digital currencies (CBDCs) are also on the rise, with countries like China, Sweden, and the Bahamas leading the charge. These government-backed digital currencies provide a more stable and regulated alternative to cryptocurrencies, allowing for faster, more secure, and more accessible cross-border transactions. The continued development and adoption of fintech in the payments sector will not only streamline global trade but also empower businesses of all sizes to expand their operations globally with ease.

Revolutionizing Lending and Credit

Another area where fintech is having a profound impact is in lending and credit services. Traditional banks have long dominated the lending market, but their conservative approaches to risk management and credit assessment have often left small businesses and individuals with limited access to capital. Fintech lenders, leveraging big data, AI, and machine learning, have transformed the way creditworthiness is assessed and loans are disbursed.

By utilizing alternative data sources, such as social media activity, transaction history, and real-time business performance metrics, fintech companies can provide more accurate and inclusive credit assessments. This has opened up lending opportunities for previously underserved individuals and businesses, particularly in emerging markets. Platforms like Kabbage, Funding Circle, and Ant Financial have pioneered the use of AI to deliver faster, more efficient loan processing, reducing approval times from weeks to mere hours or even minutes.

Peer-to-peer (P2P) lending platforms have also gained traction, allowing individuals and small businesses to access loans from individual investors rather than traditional financial institutions. This has democratized lending and provided more options for borrowers, while also offering investors the opportunity to diversify their portfolios and earn returns from lending activities. In 2025, fintech lending is expected to continue its upward trajectory, with more innovative models emerging, including the use of blockchain-based smart contracts to automate loan agreements and repayments.

The Rise of Digital Banking

Traditional banking institutions are increasingly finding themselves under pressure from digital-only banks, or “neobanks,” which offer a range of financial services without the need for physical branches. Neobanks like Revolut, N26, and Monzo have rapidly gained popularity by providing a seamless, user-friendly experience that caters to the tech-savvy customer. These banks offer everything from checking and savings accounts to foreign exchange services and investment products, all accessible through a mobile app.

The success of neobanks can be attributed to their ability to provide low-cost services, transparency, and convenience that traditional banks struggle to match. Moreover, the use of AI and data analytics allows neobanks to offer personalized financial advice, real-time spending insights, and better financial management tools. As we approach 2025, the competition between traditional banks and neobanks is expected to intensify, leading to further innovations in the digital banking space.

Neobanks are also expected to play a crucial role in expanding financial inclusion. In many developing countries, where large segments of the population remain unbanked, mobile banking solutions offer a lifeline. Fintech has empowered millions of people to access banking services through their smartphones, enabling them to save money, access credit, and participate in the formal economy. This is particularly significant in regions like Africa and Southeast Asia, where fintech-driven financial inclusion is fostering economic growth and empowering small businesses.

Asset Management and Robo-Advisors

The asset management industry has also been transformed by fintech, particularly through the rise of robo-advisors. These automated investment platforms use algorithms and data analytics to create personalized investment portfolios based on an individual’s financial goals, risk tolerance, and time horizon. Robo-advisors have democratized access to wealth management services, which were traditionally available only to high-net-worth individuals.

Companies like Betterment, Wealthfront, and Robinhood have popularized the use of robo-advisors, offering low-cost investment options that appeal to younger, tech-savvy investors. By automating the investment process, these platforms reduce the need for human financial advisors, making investing more affordable and accessible to a wider audience. Moreover, fintech solutions in asset management are increasingly integrating AI-driven analytics to predict market trends and optimize investment strategies.

In 2025, the asset management industry is expected to see even greater disruption as more advanced AI technologies and data analytics tools are integrated into investment platforms. Additionally, the use of decentralized finance (DeFi) platforms, which allow users to trade, lend, and borrow assets without intermediaries, is expected to grow. These platforms, powered by blockchain technology, are further challenging traditional financial institutions by offering decentralized and transparent investment opportunities.

Insurance and Insurtech Innovation

Fintech’s impact is not limited to banking and payments; the insurance industry is also undergoing a digital transformation, often referred to as “insurtech.” Traditional insurance companies are facing stiff competition from new entrants that leverage AI, big data, and IoT (Internet of Things) devices to offer more personalized and dynamic insurance products.

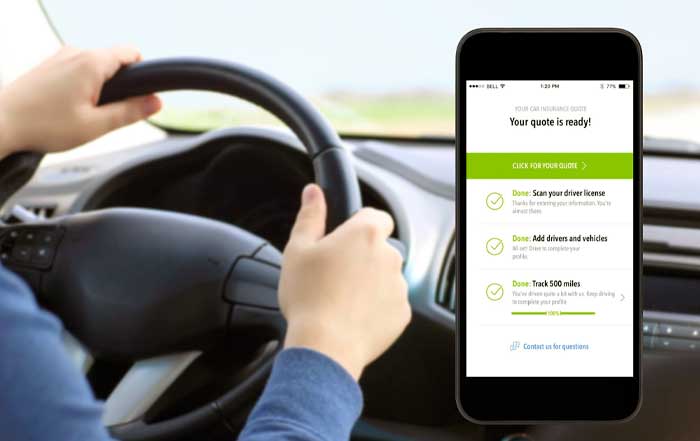

Insurtech companies like Lemonade, Metromile, and Root are redefining the insurance experience by offering policies that are flexible, transparent, and tailored to individual behavior. For example, telematics-based car insurance policies use data from IoT devices installed in vehicles to track driving behavior and adjust premiums accordingly. Similarly, health insurance companies are increasingly using wearable devices to monitor policyholders’ activity levels and offer discounts based on healthy lifestyle choices.

By 2025, insurtech is expected to play a crucial role in the broader shift toward value-based insurance models, where premiums are calculated based on real-time data and individual risk profiles. This will lead to more accurate pricing, fewer claims disputes, and better overall customer satisfaction. Additionally, the use of blockchain technology in insurance could streamline the claims process, improve data security, and reduce fraud, further enhancing the customer experience.

Fintech Sectors Overview

Blockchain and Decentralized Finance (DeFi)

One of the most revolutionary aspects of fintech is the rise of blockchain technology and decentralized finance (DeFi). Blockchain’s decentralized and immutable nature makes it ideal for a wide range of financial applications, from cross-border payments and asset tokenization to smart contracts and decentralized exchanges.

DeFi platforms, built on blockchain networks like Ethereum, allow users to engage in financial activities such as lending, borrowing, trading, and earning interest without relying on traditional intermediaries like banks or brokers. These platforms operate using smart contracts, which are self-executing contracts with terms written directly into code. By eliminating the need for intermediaries, DeFi has the potential to lower transaction costs, increase transparency, and create new opportunities for financial innovation.

In 2025, DeFi is expected to continue growing in popularity, attracting more institutional investors and mainstream users. As the regulatory environment around blockchain and cryptocurrencies becomes clearer, DeFi platforms are likely to become more integrated with traditional financial systems, offering a hybrid model that combines the benefits of decentralization with the stability of traditional finance.

Regulatory Challenges and Compliance

As fintech continues to disrupt traditional financial systems, it also faces significant regulatory challenges. Governments and regulatory bodies around the world are working to strike a balance between fostering innovation and protecting consumers and financial stability. The rapid pace of fintech innovation often outstrips the ability of regulators to keep up, leading to a complex and evolving regulatory landscape.

In 2025, fintech companies will need to navigate a range of regulatory issues, including data privacy, anti-money laundering (AML) compliance, and cybersecurity. As fintech solutions become more integrated into global financial systems, the need for robust regulatory frameworks will become even more critical. Regulators will also need to address the rise of decentralized finance and cryptocurrencies, which operate outside of traditional financial systems and pose unique challenges in terms of oversight and risk management.

At the same time, regulatory sandboxes—controlled environments where fintech companies can test new products and services under the supervision of regulators—are likely to play a key role in fostering innovation. These sandboxes allow fintech startups to experiment with new ideas without being burdened by the full weight of regulatory compliance, enabling them to bring innovative products to market more quickly.

The Future of Fintech in Global Business

Looking ahead to 2025 and beyond, fintech is poised to play an even more integral role in the global business landscape. The continued growth of digital banking, payments, lending, and asset management, combined with the rise of decentralized finance and blockchain, will create new opportunities for businesses and consumers alike.

As fintech companies continue to innovate, they will drive greater financial inclusion, empower small businesses, and streamline global trade. However, they will also need to navigate a complex regulatory environment and address concerns around data privacy, security, and ethical use of AI and other emerging technologies. Ultimately, the fintech revolution is far from over, and its impact on global business will only continue to grow in the years to come. By 2025, fintech will have transformed nearly every aspect of the financial services industry, creating a more efficient, inclusive, and interconnected global economy.