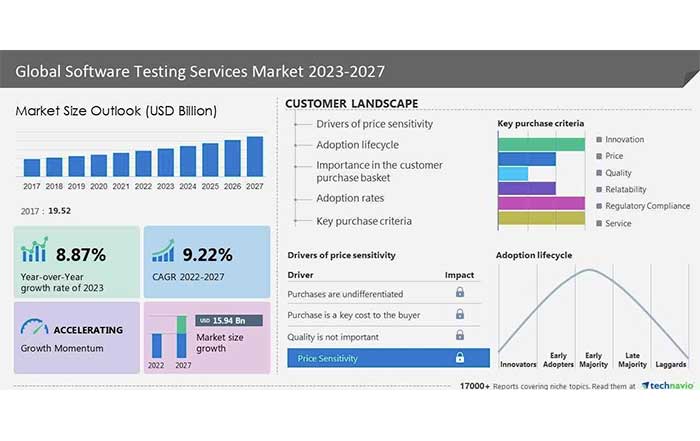

The global software testing market is on the brink of a substantial surge, with projections indicating an increase of approximately USD 16 billion between the years 2024 and 2027. This remarkable growth trajectory is primarily fueled by the escalating adoption of digital technologies and the ever-present need for rigorous software quality assurance. As businesses worldwide continue to integrate digital solutions into their operations, the demand for reliable and efficient software testing practices has become more critical than ever.

Innovation Fuels Market Expansion

The software testing industry is witnessing rapid evolution, with crowdsourced testing emerging as one of the most influential trends shaping the future of this sector. Crowdsourced testing harnesses the collective power of a global community of temporary workers, who are engaged to validate and verify software applications across diverse platforms. This approach offers several distinct advantages, including output-based pricing models, extensive device and geographical coverage, and the ability to perform real-time testing on a wide array of applications. The adoption of Agile testing methodologies, DevOps practices, Artificial Intelligence (AI), and security testing is also gaining momentum, further driving the expansion of the market. The availability of free tools and the growing popularity of test automation services are pivotal in enhancing the efficiency and accuracy of software testing processes. These developments underscore the importance of security and the prevalent practice of outsourcing testing tasks, which remain critical to ensuring that software applications are both secure and functional.

Overcoming Challenges in Software Testing

The software testing market encompasses a broad spectrum of testing types, each essential to maintaining the quality and reliability of software systems and applications. Functional testing, compatibility testing, usability testing, security testing, and load testing are just a few examples of the various testing methodologies employed to ensure software performs as intended. These tests are indispensable in guaranteeing that software applications are not only functional but also compatible with different platforms and user environments. Moreover, as the adoption of Agile and DevOps methodologies continues to rise, the demand for mobile-based testing has surged, necessitating continuous updates and adaptations to testing strategies. The proliferation of cloud-based testing solutions has also brought security threats to the forefront, highlighting the need for robust testing frameworks and ongoing training programs for testing professionals. Addressing these challenges requires a comprehensive approach that integrates cutting-edge technologies, continuous learning, and a deep understanding of the evolving software landscape.

Global Software Testing Market Growth

Insights from Industry Analysts

In the rapidly changing landscape of the Software Testing Market, various testing methodologies play a vital role in ensuring the seamless functionality, compatibility, usability, security, and load-handling capabilities of software applications, platforms, and systems. Agile and DevOps methodologies have revolutionized the testing process by promoting continuous application updates and fostering a culture of collaboration between development and operations teams. This shift has also emphasized the importance of mobile-based testing, particularly in an era where mobile applications are becoming increasingly central to business operations. Among the key testing services that have gained prominence are test automation, crowdsourced testing, and Agile testing. These services leverage the power of Artificial Intelligence (AI) and Machine Learning (ML) to enhance the efficiency, accuracy, and speed of testing processes, making them indispensable tools for modern software development.

Overview of the Software Testing Market

The Software Testing Market stands as a significant pillar within the broader technology industry, encompassing a wide range of testing techniques, tools, and methodologies. The market is characterized by the presence of various companies that specialize in providing testing services tailored to the specific needs of their clients. Among these companies are Funational, Compability, Secury, Testing, Usability, and Performance Forms, each offering a unique set of testing services that include crowdsourced testing, DevOps testing, robust testing, automated testing, and mobile testing. These services are designed to ensure that software applications not only function correctly but also meet stringent security requirements and user expectations. Additionally, companies like Applicatio and Online testing solutions provide a variety of app and website testing services, catering to the diverse needs of businesses in different sectors. The growth of the software testing market is being driven by the increasing demand for high-quality software, the widespread adoption of Agile and DevOps methodologies, and the ongoing digital transformation that is reshaping industries across the globe.

Key Players in the Software Testing Market

The Software Testing Market is highly fragmented, with numerous companies vying for a share of the market. The major players in this space have established strong economies of scale and a significant market presence, which they leverage to maintain their competitive edge. These companies often rely on technological advancements and strategic pricing to differentiate themselves from their competitors. The market is populated by several leading vendors, including Atos SE, Capgemini Service SAS, Cognizant Technology Solutions Corp., DeviQA Solutions, Expleo Group SAS, Hexaware Technologies Ltd., Infosys Ltd., International Business Machines Corp., Kualitatem Inc., Oxagile, QA Mentor Inc., QA TestLab Solutions Ltd., QASource, QualiTest Group, QualityLogic Inc., Tata Consultancy Services Ltd., Testfort, Wipro Ltd., and LogiGear Corp. These companies are at the forefront of innovation in the software testing industry, continuously introducing new products and services to meet the evolving needs of their clients. Reports on the Software Testing Market often include detailed information on product launches, sustainability initiatives, and the future prospects of these leading vendors, providing valuable insights for businesses looking to optimize their market position.

Insights from Technavio

Technavio, a leading global technology research and advisory company, plays a crucial role in providing actionable insights that help businesses identify market opportunities and develop effective strategies to enhance their market positions. With a team of over 500 specialized analysts, Technavio offers an extensive report library that includes more than 17,000 reports covering 800 technologies across 50 countries. The company’s client base is diverse, encompassing enterprises of all sizes, including more than 100 Fortune 500 companies. Technavio’s insights are instrumental in helping businesses navigate the complexities of the software testing market and capitalize on emerging trends and opportunities.

The software testing market is a critical component of the technology industry, driven by the growing need for robust software quality assurance and the rapid adoption of digital technologies. As the market continues to evolve, companies must remain agile and innovative, leveraging cutting-edge testing techniques and tools such as crowdsourced testing and AI-driven testing to ensure the quality and reliability of their software applications. By staying ahead of the curve, businesses can not only meet the demands of the present but also position themselves for success in the future.