The Indonesian international remittance market has become a focal point of economic growth, driven by the nation's robust and expanding economy, coupled with its increasing global connectivity. As Indonesia continues to play an essential role in the global economic landscape, the remittance market has surged, presenting a lucrative opportunity for businesses, investors, and financial institutions eager to capitalize on this evolving financial sector. This article examines the current dynamics of the Indonesian remittance market, providing an in-depth analysis of its size, growth trajectory, key drivers, challenges, and the transformative role of fintech in reshaping the market. By exploring these aspects we aim to offer a comprehensive understanding of the market's potential, the competitive landscape, and the strategic steps necessary to sustain its growth and overcome the challenges ahead.

Market Size and Growth Trajectory

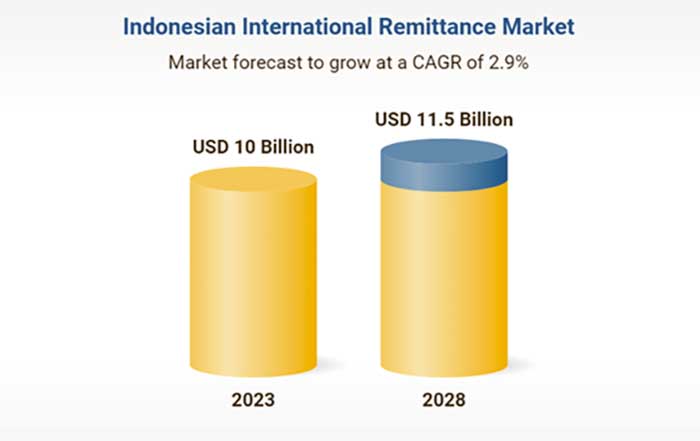

The Indonesian international remittance market has shown remarkable growth in recent years, reflecting the broader economic development and the increasing integration of the country into the global economy. In 2022, the market witnessed a significant expansion, with the international inbound remittance market growing by 3.6%, reaching an impressive value of US$ 9.95 billion. This growth is not an isolated event but part of a broader upward trend that is expected to persist over the coming years. Forecasts for the period from 2023 to 2028 suggest that the market will continue to expand at a compound annual growth rate (CAGR) of 2.9%, which will likely see the market's value rise to US$ 11.51 billion by 2028.

Similarly, the international outbound remittance market has also experienced noteworthy growth. In 2022, this segment of the market expanded by 4.0%, reaching a value of US$ 4.63 billion. Projections indicate that the outbound remittance market will grow at a CAGR of 3.3% over the forecast period, potentially reaching US$ 5.46 billion by 2028. These figures underscore the robust nature of the market and highlight the significant economic activities that are propelling its growth.

The steady increase in remittance flows can be attributed to several macroeconomic and demographic factors, including the rising number of Indonesians working abroad, the steady flow of foreign direct investment, and the increasing integration of Indonesia into the global supply chain. These factors, coupled with the growing use of digital platforms for financial transactions, have created a fertile ground for the remittance market to flourish.

Key Drivers of Growth

The expansion of the Indonesian remittance market is driven by a confluence of factors that are both domestic and international in nature. Among the primary drivers of growth is the decline in inflation levels within Indonesia. Lower inflation boosts the purchasing power of remittance recipients, as the value of money sent from abroad stretches further, allowing recipients to afford more goods and services. This dynamic, in turn, encourages higher remittance inflows, as senders are more likely to remit larger amounts when they perceive that their money has greater value in the home country.

Another critical factor contributing to the market's growth is the increasingly competitive landscape. As the market matures, it is attracting new players, including global financial institutions and fintech companies, eager to tap into this lucrative sector. The entry of these new players has not only expanded the range of services available to consumers but also driven down costs, making remittance services more accessible and affordable. The increased competition has spurred innovation, leading to the development of new products and services that cater to the diverse needs of consumers, from low-cost transfers to more sophisticated financial products.

The growing adoption of digital payment solutions and the expansion of fintech services are also pivotal in driving the growth of the remittance market. Digital platforms offer a level of convenience, speed, and cost-efficiency that traditional banking services often cannot match. As more consumers and businesses embrace digital payment solutions, the volume of remittance transactions conducted through these channels is expected to rise significantly. Fintech companies, in particular, have been instrumental in introducing innovative solutions that cater to the unique needs of the Indonesian market, from mobile money services to blockchain-based remittance platforms.

Indonesian Remittance Market Timeline

2022

Inbound remittances: $9.95 billion (+3.6%)

Outbound remittances: $4.63 billion (+4.0%)

2023-2028

Projected CAGR:

Inbound: 2.9% → $11.51 billion by 2028

Outbound: 3.3% → $5.46 billion by 2028

Recent Developments

• SBI Group partners with Ripple for XRP remittances

• Fasset enters Indonesian market

• Brick acquires PT Eastern Transglobal Remittance

Future Initiatives

• Cross-border QR payments with Singapore

• Digital payment infrastructure expansion

• Rural connectivity improvement

The Competitive Landscape and the Role of Global Players

The attractiveness of the Indonesian remittance market has not gone unnoticed by global players, who are increasingly seeking to establish a presence in the region. The entry of these global companies has intensified competition, driving innovation and leading to better services for consumers. Among the notable global players making inroads into the Indonesian market is SBI Group, a Japanese conglomerate that has partnered with Ripple and SBI Ripple Asia to provide XRP-based remittance services in Indonesia and other Southeast Asian countries. This partnership leverages Ripple's blockchain technology to offer faster, more secure, and cost-effective cross-border payment solutions, which are particularly appealing in a market where traditional remittance services can be slow and expensive.

Another significant player entering the Indonesian market is Fasset, a Middle Eastern firm that is expanding into the region with plans to introduce remittance services. Fasset's entry into the market is part of a broader strategy to tap into the growing demand for digital financial services in Southeast Asia, where a young, tech-savvy population is driving the adoption of digital payment solutions. The influx of new players like SBI Group and Fasset is likely to lead to increased competition, which will benefit consumers by providing them with more choices and better service offerings.

The presence of global players in the Indonesian remittance market also highlights the broader trend of increasing globalization in the financial services industry. As markets become more interconnected, companies are looking beyond their domestic borders to expand their operations and tap into new growth opportunities. For Indonesia, the entry of these global players brings not only competition but also valuable expertise and technology that can help accelerate the development of the country's financial infrastructure.

Challenges and Infrastructure Development

Despite the positive growth outlook, the Indonesian remittance market faces several significant challenges that could hinder its long-term development. One of the most pressing challenges is the underdeveloped infrastructure in many parts of the country, particularly in rural areas. While urban centers like Jakarta and Surabaya have relatively well-developed financial infrastructures, many rural areas lack the basic infrastructure needed to support modern financial services, including reliable internet access and banking facilities. This infrastructure gap makes it difficult for remittance services to reach all corners of the country, limiting the market's growth potential.

In addition to infrastructure challenges, Indonesia's healthcare system and education sector also require significant improvement to support the growing economy. A strong healthcare system is essential for ensuring a healthy workforce, which is crucial for sustaining economic growth. Similarly, an improved education system is necessary to equip the population with the skills needed to thrive in a rapidly changing economy. Addressing these challenges will be critical for unlocking the full potential of the remittance market and ensuring its long-term sustainability.

The Indonesian government has recognized these challenges and is taking steps to address them. For example, the government has launched various infrastructure development programs aimed at improving connectivity and access to financial services in rural areas. These initiatives include the expansion of mobile network coverage, the construction of new roads and bridges, and the development of digital payment platforms that can operate in areas with limited infrastructure. By improving infrastructure and access to financial services, the government hopes to create an environment that is conducive to the growth of the remittance market and the broader economy.

The Transformative Role of Fintech and Digital Payments

Fintech companies have emerged as key players in the Indonesian remittance market, providing innovative digital payment solutions that are transforming the way remittances are sent and received. These companies are leveraging technology to offer services that are not only more efficient but also more accessible to a broader range of consumers. One of the most notable examples of fintech innovation in the Indonesian remittance market is the acquisition of a majority stake in PT Eastern Transglobal Remittance (ETR) by Brick, an Indonesian fintech firm. This acquisition has allowed Brick to launch three new B2B payment products: BrickPay, BrickFlex, and Brick Financial API.

These digital payment solutions are designed to cater to the diverse needs of businesses and consumers in Indonesia. BrickPay, for example, offers a low-cost, high-speed remittance service that allows businesses to send payments to their employees and suppliers quickly and efficiently. BrickFlex is a flexible payment solution that can be tailored to the specific needs of businesses, while Brick Financial API provides a platform for integrating digital payment services into existing business systems. These products are not only more efficient than traditional payment methods but also more cost-effective, making them attractive to both senders and recipients.

The expansion of digital payment solutions in Indonesia is also being driven by the increasing adoption of smartphones and mobile internet. As more Indonesians gain access to smartphones and mobile internet, the use of digital payment platforms is expected to rise, further fueling the growth of the remittance market. Fintech companies are capitalizing on this trend by developing mobile-first payment solutions that are easy to use and accessible to a broad range of consumers, including those in rural areas where access to traditional banking services is limited.

Cross-Border QR Code Payments: A New Frontier

In a move that could further accelerate the growth of the Indonesian remittance market, the country's central bank has initiated a trial of cross-border QR code payments with Singapore. This innovative payment system allows individuals and businesses to make instant and secure payments across borders using QR codes, which can be scanned with a smartphone. The introduction of cross-border QR code payments is expected to have a significant impact on the remittance market, particularly for small and medium-sized enterprises (SMEs) and the tourism industry.

For SMEs, the ability to make cross-border payments quickly and securely is a game-changer, as it reduces the time and cost associated with traditional payment methods. This is particularly important for businesses that operate in multiple countries or engage in international trade, as it allows them to streamline their payment processes and improve cash flow. The tourism industry, which is a major contributor to the Indonesian economy, is also expected to benefit from the introduction of cross-border QR code payments, as it makes it easier for tourists to make payments while traveling.

The success of the cross-border QR code payment initiative could pave the way for further expansion of digital payment solutions in Indonesia and the broader Southeast Asian region. If widely adopted, this payment system could become a key driver of growth for the remittance market, as it offers a level of convenience and security that traditional payment methods cannot match. Moreover, the introduction of cross-border QR code payments highlights the broader trend of digitalization in the financial services industry, as more countries and companies embrace digital payment solutions to meet the needs of a globalized economy.

Unlocking the Potential of the Indonesian Remittance Market

The Indonesian international remittance market is poised for significant growth in the coming years, driven by the country's robust economic growth and increasing global connectivity. As the market continues to expand, it presents a vast opportunity for businesses, investors, and financial institutions to tap into the lucrative remittance landscape. However, realizing the full potential of the market will require addressing several challenges, including infrastructure development, healthcare, and education.

Fintech companies will play a crucial role in overcoming these challenges and driving the growth of the remittance market. By providing innovative digital payment solutions, fintech companies are making remittance services more accessible, efficient, and cost-effective, ultimately benefiting both senders and recipients. The introduction of new payment systems, such as cross-border QR code payments, further underscores the transformative potential of digitalization in the remittance market.

With the right support and infrastructure development, Indonesia can harness the potential of its remittance market to accelerate access to inclusive finance and drive economic growth. By addressing the challenges that lie ahead and embracing the opportunities presented by digitalization, Indonesia has the potential to become a leading player in the global remittance market, setting an example for other countries in the region and beyond. The future of the Indonesian remittance market is bright, and with continued innovation and investment, it is well-positioned to unlock new opportunities for economic growth and financial inclusion.