As the landscape of work continues to evolve, the job market in France is experiencing a significant transformation, particularly in the finance and technology sectors. The year 2024 is shaping up to be a pivotal moment for professionals seeking opportunities in these fields, driven by advancements in technology, changes in consumer behavior, and a robust economic environment. We will give you a guide on the most sought-after finance and tech jobs in France, providing insights into job descriptions, salary ranges, company overview and the broader industry market.

Overview of the Job Market

The French economy has shown resilience and growth, with a projected GDP increase of approximately 3.5% in 2024. This positive economic trajectory has been bolstered by government initiatives aimed at fostering innovation and supporting emerging industries. As a result, the demand for skilled professionals in finance and technology is on the rise, with a notable emphasis on roles that leverage data, enhance cybersecurity, and drive digital transformation.

Key Economic Indicators

- GDP Growth: Projected at 3.5% for 2024.

- Inflation Rate: Stable around 2%, contributing to consumer purchasing power.

- Unemployment Rate: Gradually declining, indicating a tightening labor market.

This economic backdrop has created fertile ground for job growth, particularly in sectors that are at the forefront of technological innovation and financial services.

Most In-Demand Tech Jobs

The technology sector in France is particularly vibrant, with several roles emerging as highly sought after. The following positions are expected to dominate the job market in 2024:

1. Cloud Architect

Job Description: Cloud Architects are responsible for designing and managing cloud computing strategies for organizations, ensuring that cloud solutions are efficient, secure, and scalable.

Salary Range: €45,000 to €81,100 per year.

Company Products and Services: Cloud Architects work with companies that provide cloud services, such as Amazon Web Services, Microsoft Azure, and Google Cloud Platform, helping businesses transition to cloud-based solutions.

Industry Market: The cloud computing market in France is projected to reach €70 billion in 2024, driven by increased adoption of digital technologies across various sectors.

2. Data Scientist

Job Description: Data Scientists analyze complex data sets to inform business decisions, utilizing statistical methods and machine learning techniques to extract insights.

Salary Range: €43,000 to €65,000 per year.

Company Products and Services: Data Scientists are employed across industries, including finance, healthcare, and e-commerce, working with companies like Criteo and BNP Paribas to optimize their data strategies.

Industry Market: The demand for data analytics is surging, with businesses increasingly relying on data-driven insights to enhance operational efficiency and customer engagement.

3. Cybersecurity Specialist

Job Description: Cybersecurity Specialists protect an organization’s information systems from cyber threats, implementing security measures and responding to incidents.

Salary Range: €48,000 to €78,000 per year.

Company Products and Services: These professionals are crucial for companies that handle sensitive data, such as financial institutions and tech firms, ensuring compliance with regulations and safeguarding customer information.

Industry Market: With the rise in cyber threats, the cybersecurity market in France is expected to grow significantly, emphasizing the need for skilled professionals in this area.

Most In-Demand Finance Jobs

The finance sector in France is also undergoing a transformation, with several key roles emerging as essential for organizations looking to thrive in a competitive environment.

1. Financial Analyst

Job Description: Financial Analysts evaluate financial data to assist organizations in making informed investment decisions, conducting research, and preparing financial reports.

Salary Range: €40,000 to €70,000 per year.

Company Products and Services: Financial Analysts often work for banks, investment firms, and corporate finance departments, providing insights that drive strategic planning and investment strategies.

Industry Market: The financial services sector remains a cornerstone of the French economy, with Paris being a major financial hub in Europe.

2. Fintech Specialist

Job Description: Fintech Specialists focus on the intersection of finance and technology, developing innovative financial solutions that leverage technology to improve customer experiences.

Salary Range: €50,000 to €90,000 per year.

Company Products and Services: These professionals are pivotal in companies like Revolut and N26, which are redefining banking and financial services through technology.

Industry Market: The fintech industry in France is rapidly expanding, with numerous startups and established firms investing in technology to enhance financial services.

3. Risk Manager

Job Description: Risk Managers identify and analyze potential risks that could threaten the assets or earning capacity of an organization, implementing strategies to mitigate these risks.

Salary Range: €55,000 to €85,000 per year.

Company Products and Services: Risk Managers are essential in financial institutions, insurance companies, and corporations, ensuring compliance with regulations and safeguarding against financial losses.

Industry Market: As regulatory requirements increase and the financial landscape becomes more complex, the demand for skilled Risk Managers is expected to rise.

Skills and Qualifications

To succeed in these in-demand roles, candidates must possess a combination of technical skills, industry knowledge, and soft skills. Key competencies include:

- Technical Proficiency: Familiarity with programming languages (Python, Java), data analysis tools (R, SQL), and cloud platforms (AWS, Azure).

- Analytical Skills: Strong analytical abilities to interpret data and make informed decisions.

- Communication Skills: The ability to convey complex information clearly and effectively to stakeholders.

- Problem-Solving: An aptitude for identifying issues and developing innovative solutions.

Here are the top 5 fintech companies in France offering the in-demand finance and tech roles mentioned:

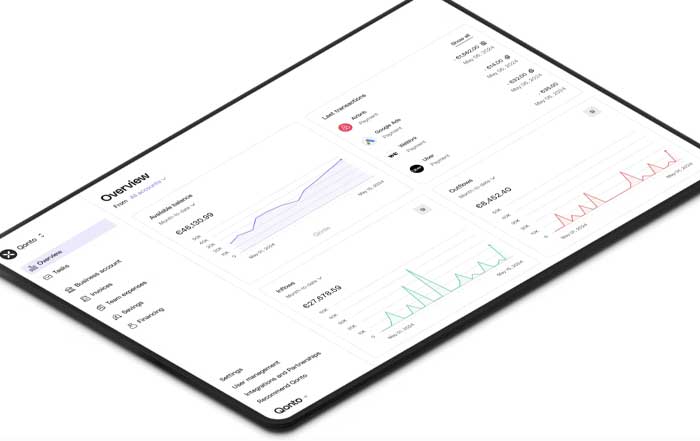

1. Qonto - Provides business banking solutions and offers roles in software engineering, sales, marketing, and cybersecurity.

2. Ledger - Develops cryptocurrency wallets and services, with positions available in design, software engineering, sales, marketing, and cybersecurity.

3. Shift Technology - Uses AI for insurance fraud detection, hiring for roles in fintech app development, data science, and project management.

4. Spendesk - Offers corporate expense management tools and has openings in design, software engineering, sales, marketing, and cybersecurity.

5. Alan - A health insurance startup that has raised significant funding and likely has roles in data science, software engineering, and product management.

These companies are at the forefront of fintech innovation in France, providing cutting-edge financial solutions while creating jobs in high-demand areas like cloud architecture, data science, and cybersecurity. The robust funding they have raised demonstrates the growth potential in the French fintech sector.

France Tech & Finance Jobs Quiz 2024

The job market in France for 2025 is poised for more growth, particularly in the finance and technology sectors. As businesses continue to embrace digital transformation, the demand for skilled professionals in these fields will only increase. With competitive salaries, diverse opportunities, and a supportive economic environment, now is an opportune time for individuals to pursue careers in these dynamic industries. The future of work in France is bright, and those equipped with the right skills and qualifications will find themselves at the forefront of this exciting evolution.