Remote work has become increasingly prevalent, offering professionals worldwide the opportunity to contribute their skills and expertise to innovative companies. As the FinTech market continues to grow, with projections of exceeding $340 billion in 2024 and reaching $1,152 billion by 2032, the demand for skilled remote workers has never been higher. The FinTech industry has seen a significant shift in recent years, with the United States leading the charge in investment deals at 40.5% in 2023, followed by Europe at 23.75% and Asia at 20.5%. This global interest in FinTech has created a diverse array of remote job opportunities, catering to professionals from various backgrounds and skill sets.

Fintech Analyst: Uncovering Insights for Growth

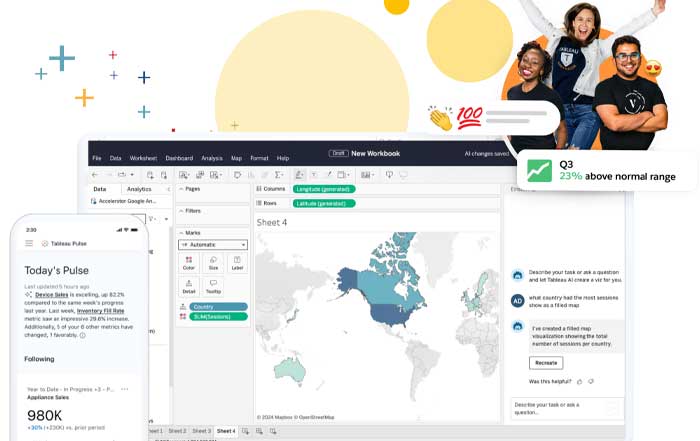

One of the most sought-after remote positions in the FinTech industry is that of a Fintech Analyst. These professionals are responsible for analyzing large datasets to identify patterns, trends, and opportunities that can drive business growth. A Fintech Analyst II - Discounts role at StubHub, for example, requires expertise in SQL, SSRS, Snowflake, and Tableau to transform data, optimize systems, and contribute to in-house FinTech solutions.

To excel as a Fintech Analyst, candidates should possess a strong background in data analysis, proficiency in relevant tools and programming languages, and the ability to translate complex data into actionable insights. The average salary for a Data Scientist in the FinTech industry, a closely related role, is around $120,000.

Blockchain Developer: Shaping the Future of Secure Transactions

As blockchain technology continues to revolutionize the financial sector, the demand for skilled Blockchain Developers has skyrocketed. These professionals are responsible for creating and maintaining blockchain-based systems and applications that ensure secure and transparent transactions. With more companies adopting blockchain technology, the need for qualified remote Blockchain Developers is expected to grow significantly in the coming years.

To become a successful Blockchain Developer, individuals should have a strong foundation in programming languages, experience with blockchain frameworks and protocols, and a deep understanding of cryptography and consensus algorithms. As the FinTech industry continues to embrace blockchain technology, remote Blockchain Developers can expect competitive salaries and exciting opportunities to shape the future of secure financial transactions.

Fintech Product Manager: Bridging the Gap Between Technology and Business

Fintech Product Managers play a crucial role in aligning technology with business objectives, ensuring that FinTech products and services meet the evolving needs of customers. These professionals are responsible for defining product requirements, managing the development process, and collaborating with cross-functional teams to deliver innovative solutions.

A Product Manager II role at StubHub, for example, involves working closely with engineering, design, and business teams to drive the development of in-house FinTech products. To excel in this position, candidates should possess strong communication skills, a deep understanding of the FinTech landscape, and the ability to translate business requirements into technical specifications.

Fintech Sales: Driving Growth in a Digital Age

As FinTech companies strive to expand their customer base and market share, the demand for skilled Fintech Sales professionals has grown exponentially. These individuals are responsible for identifying potential clients, building relationships, and closing deals that contribute to the overall success of the organization.

A Fintech Sales role at VantagePoint A.I., for example, offers stability, competitive compensation, and the opportunity to work with cutting-edge FinTech solutions. To succeed in this position, candidates should have a proven track record in sales, excellent communication skills, and a deep understanding of the FinTech industry and its products.

Fintech Operations Trainer: Ensuring Smooth Transitions

Fintech Operations Trainers play a crucial role in ensuring that FinTech solutions are implemented seamlessly and that end-users are equipped with the necessary knowledge and skills to maximize their effectiveness. These professionals are responsible for developing training materials, conducting workshops, and providing ongoing support to clients and internal teams.

An example of a Fintech Operations Trainer role is at Everi, where the successful candidate will be based in the FinTech Innovation Center in Las Vegas and report to the Customer Experience Manager. To excel in this position, individuals should have strong training and facilitation skills, a deep understanding of FinTech operations, and the ability to adapt to the unique needs of each client.

FinTech Remote Work Roadmap

Navigating the Remote Fintech Job Market: Tips for Success

As the FinTech industry continues to embrace remote work, professionals seeking opportunities in this dynamic field must adapt their job search strategies to stand out in a competitive market. Here are some tips for navigating the remote FinTech job market:

1. Develop a Strong Online Presence: Create a professional profile on platforms like LinkedIn, highlighting your skills, experience, and achievements in the FinTech industry. Engage with the FinTech community, share relevant content, and build a network of industry professionals.

2. Stay Up-to-Date with Industry Trends: Keep abreast of the latest developments in the FinTech industry, including new technologies, regulations, and market trends. This knowledge will help you tailor your skills and experience to the specific needs of FinTech companies and demonstrate your commitment to the field.

3. Highlight Your Remote Work Experience: If you have experience working remotely, emphasize your ability to work independently, communicate effectively, and collaborate with distributed teams. Showcase projects or achievements that demonstrate your remote work skills and adaptability.

4. Tailor Your Resume and Cover Letter: Customize your resume and cover letter for each FinTech company you apply to, highlighting your relevant skills and experience. Use keywords from the job description and demonstrate how your qualifications align with the company's needs and values.

5. Prepare for Remote Interviews: Be ready to discuss your remote work experience, technical skills, and problem-solving abilities during the interview process. Practice using video conferencing tools and be prepared to answer questions about your ability to work independently and collaborate remotely.

6. Leverage Your Network: Reach out to your professional network for referrals, job leads, and advice on navigating the remote FinTech job market. Attend virtual industry events, participate in online communities, and engage with FinTech professionals to expand your network and uncover new opportunities.

The Future of Remote Work in Fintech: Trends and Opportunities

As the FinTech industry continues to evolve, the future of remote work in this dynamic field looks bright. Here are some key trends and opportunities to watch:

1. Increased Adoption of Artificial Intelligence and Machine Learning: FinTech companies are increasingly leveraging AI and ML to automate processes, personalize customer experiences, and detect fraud. This trend is expected to drive the demand for remote AI and ML specialists, including Data Scientists, Machine Learning Engineers, and Natural Language Processing experts.

2. Growth of Decentralized Finance (DeFi): DeFi, which refers to the use of blockchain technology to provide financial services without intermediaries, is gaining traction in the FinTech industry. As more companies explore DeFi solutions, the demand for remote Blockchain Developers and Cryptocurrency Analysts is likely to increase.

3. Expansion of Embedded Finance: Embedded finance, which involves integrating financial services into non-financial platforms, is expected to grow significantly in the coming years. This trend may create opportunities for remote FinTech professionals with expertise in areas such as API development, user experience design, and product management.

4. Increasing Focus on Cybersecurity: As FinTech companies handle sensitive financial data and transactions, the importance of cybersecurity has never been higher. Remote Cybersecurity Specialists, including Penetration Testers, Security Analysts, and Incident Response Managers, will be in high demand to protect FinTech systems and data from cyber threats.

5. Globalization of the FinTech Workforce: The rise of remote work has enabled FinTech companies to tap into a global talent pool, allowing them to hire the best professionals regardless of location. This trend may lead to increased collaboration between remote teams from different countries and cultures, fostering innovation and diversity in the FinTech industry.

Conclusion

The remote FinTech job market offers a wealth of opportunities for professionals seeking to contribute their skills and expertise to innovative companies shaping the future of finance. From Data Scientists to Blockchain Developers, Fintech Product Managers to Cybersecurity Specialists, the demand for skilled remote workers in the FinTech industry is expected to continue growing in the coming years.

By staying up-to-date with industry trends, developing a strong online presence, and leveraging their network, professionals can navigate the remote FinTech job market and find fulfilling careers that align with their passions and skills. As the FinTech industry evolves, the future of remote work in this dynamic field looks bright, with exciting opportunities for growth, innovation, and global collaboration.