Switzerland, renowned for its robust financial sector, has emerged as a prominent hub for fintech innovation, attracting a plethora of startups and established companies alike. The Swiss fintech landscape is characterized by a diverse range of services, including digital banking, payment solutions, investment management, and blockchain technology. Today we investigate some of the top fintech companies in Switzerland, examining their market share, expected profits and revenues for 2024, employee counts, leadership structures, product offerings, historical context, and future growth projections for 2025.

1. Yokoy

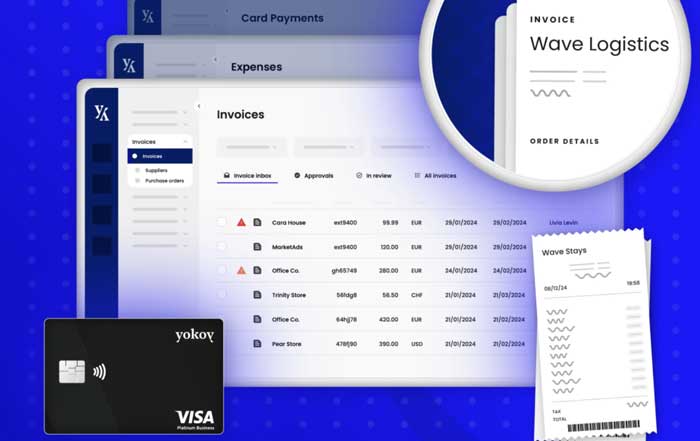

Yokoy, a Zurich-based fintech company, specializes in automating expense management and invoicing processes for businesses. Founded in 2020, Yokoy has quickly gained traction, securing over CHF 108 million in funding during its Series B round. The company employs around 250 staff members and is led by a team of experienced professionals from the finance and technology sectors. In 2024, Yokoy is expected to achieve revenues of approximately CHF 30 million, reflecting its growing customer base and the increasing demand for automated financial solutions. Looking ahead to 2025, Yokoy aims to expand its services to include more comprehensive financial management tools, positioning itself as a leader in the fintech automation space.

2. Revolut

Founded in 2015, Revolut has rapidly become one of the leading fintech companies in Switzerland, offering a comprehensive suite of financial services that includes currency exchange, stock trading, and cryptocurrency transactions. With over 20 million users globally, Revolut's Swiss operations have contributed significantly to its growth. In 2024, the company is projected to generate revenues exceeding CHF 1 billion, driven by its innovative banking solutions and expanding user base. The Head Office is in London however the company employs approximately 500 individuals in Switzerland, with a leadership team focused on enhancing customer experience and expanding product offerings. Revolut's future growth projections for 2025 indicate a continued emphasis on technological advancements and market expansion, particularly in the areas of cryptocurrency and international payments.

3. SEBA Bank is now called AMINA

SEBA Bank made history in 2019 by becoming one of the first FINMA-regulated institutions to provide crypto banking services. This rebrand marks a new chapter for the company, which has proudly been in operation for more than four years. AMINA Bank is inspired by the same trailblazing ambition to lead the way for its clients and to write its own future as a Swiss-regulated crypto bank offering services to its traditional and crypto savvy clients around the globe. Their HQ is in Zug.

4. Sygnum

Sygnum, another leading digital asset bank, was founded in 2017 and has quickly established itself as a key player in the Swiss fintech ecosystem. The company offers a range of services, including digital asset custody, trading, and tokenization. With a current employee count of around 250, Sygnum is expected to generate revenues of CHF 60 million in 2024. The bank's leadership team is composed of industry veterans with extensive experience in finance and technology. Sygnum's growth strategy for 2025 focuses on expanding its product offerings and enhancing its global presence, particularly in Asia and Europe.

5. Swissquote

As one of Switzerland's oldest online banks, Swissquote has been at the forefront of fintech innovation since its inception in 1996. The bank offers a wide array of services, including online trading, forex, and cryptocurrency services. With over 1,000 employees, Swissquote is projected to achieve revenues of CHF 300 million in 2024. The leadership team, led by CEO Marc Bürki, is committed to enhancing the customer experience through technological advancements and innovative product offerings. Swissquote's future growth projections for 2025 include expanding its services to cater to a broader audience, particularly in the realm of sustainable investments.

6. Lykke

Lykke is a global fintech company founded in 2015, specializing in blockchain-based trading and investment solutions. The company has developed a platform that allows users to trade a wide range of assets, including cryptocurrencies and traditional financial instruments. With approximately 100 employees, Lykke is projected to achieve revenues of CHF 20 million in 2024. The leadership team, led by CEO Richard Olsen, is dedicated to driving innovation in the trading space. Lykke's growth projections for 2025 include expanding its product offerings and increasing its market presence, particularly in Asia and North America.

7. WeCan

WeCan is a blockchain-based solution provider that focuses on data management and secure communication for businesses. Established in 2020, the company has quickly gained recognition for its innovative approach to data security. With a workforce of around 50 employees, WeCan is expected to generate revenues of CHF 10 million in 2024. The leadership team is committed to developing cutting-edge solutions that address the growing concerns around data privacy and security. As the demand for blockchain solutions continues to rise, WeCan's growth projections for 2025 indicate a significant increase in customer acquisition and service diversification.

8. Payrexx

Payrexx is a payment service provider that offers a comprehensive platform for businesses to manage their online payment processes. Founded in 2014, the company has established itself as a key player in the Swiss fintech landscape, with a workforce of approximately 100 employees. In 2024, Payrexx is projected to generate revenues of CHF 15 million, driven by its innovative payment solutions and expanding customer base. The leadership team is focused on enhancing the platform's functionalities and integrating new payment methods. Looking ahead to 2025, Payrexx aims to further expand its services and strengthen its position in the competitive payment processing market.

9. Divizend

Divizend is a fintech company that specializes in automating the process of reclaiming foreign withholding taxes for investors. Founded in 2017, the company has quickly gained traction in the market, employing around 30 individuals. In 2024, Divizend is expected to achieve revenues of CHF 5 million, supported by its innovative solutions that simplify tax reclaim processes for investors. The leadership team is dedicated to expanding the company's market presence and enhancing its service offerings. As the demand for tax reclaim solutions continues to grow, Divizend's growth projections for 2025 indicate a significant increase in customer acquisition and revenue generation.

Wrapping Up

The Swiss fintech landscape is characterized by a dynamic and innovative ecosystem, with companies continuously evolving to meet the changing needs of consumers and businesses alike. The top ten fintech companies highlighted in this article not only demonstrate the strength and diversity of the sector but also underscore Switzerland's position as a leading global fintech hub. As these companies continue to grow and adapt, they are poised to play a significant role in shaping the future of finance, both in Switzerland and beyond. The expected profits, revenues, and growth projections for 2025 indicate a promising outlook for the fintech sector, driven by technological advancements and an increasing demand for innovative financial solutions.