Singapore has emerged as a global leader in the fintech industry, attracting top talent and offering lucrative career opportunities in a wide range of fintech roles. As the city-state continues to drive innovation in the financial sector, the demand for skilled professionals in fintech has never been higher. In this comprehensive article, we will explore some of the most sought-after fintech jobs in Singapore, delving into job descriptions, salary ranges, and the companies and products that are shaping the industry.

Software Engineer

Software engineers are the backbone of fintech, responsible for developing and maintaining the complex systems that power financial applications and services. In Singapore, software engineers in the fintech industry can expect to earn competitive salaries, with entry-level positions starting at around $4,500 per month and experienced engineers earning up to $10,500 per month. Companies like Backbase, Airwallex, and Nium are actively hiring software engineers to work on cutting-edge projects in areas such as digital banking, international payments, and B2B financial services.

Data Scientist

As fintech companies increasingly rely on data to drive decision-making and improve their products, the demand for skilled data scientists has skyrocketed. Data scientists in the fintech industry are responsible for collecting, analyzing, and interpreting large datasets to uncover insights that can help companies make more informed business decisions. Salaries for data scientists in fintech can range from $6,000 to $12,000 per month, depending on experience and expertise. Companies like Grab and Airwallex are actively seeking data scientists to work on projects such as fraud detection, customer segmentation, and predictive analytics.

Product Manager

Product managers play a crucial role in the fintech industry, bridging the gap between business objectives and technical capabilities. They are responsible for defining product requirements, prioritizing features, and ensuring that products meet the needs of customers and stakeholders. Product managers in fintech can expect to earn salaries ranging from $6,000 to $15,000 per month, depending on the size and complexity of the projects they manage. Companies like Grab, Wise, and Nium are actively seeking product managers to work on a variety of fintech products, from mobile wallets to international money transfer platforms.

Compliance Officer

As fintech companies operate in a highly regulated industry, compliance officers play a critical role in ensuring that companies adhere to relevant laws and regulations. Compliance officers are responsible for developing and implementing compliance policies, conducting risk assessments, and monitoring transactions for suspicious activity. Salaries for compliance officers in fintech can range from $5,000 to $10,000 per month, depending on the size and complexity of the company. Companies like Wise and Nium are actively seeking compliance officers to work on projects such as anti-money laundering (AML) and know-your-customer (KYC) compliance.

Business Development Manager

Business development managers in the fintech industry are responsible for identifying and pursuing new business opportunities, building strategic partnerships, and driving revenue growth. They work closely with sales, marketing, and product teams to develop and execute go-to-market strategies that align with the company's overall business objectives. Salaries for business development managers in fintech can range from $6,000 to $12,000 per month, depending on the size and complexity of the company and the deals they are responsible for. Companies like Grab, Wise, and Nium are actively seeking business development managers to work on projects such as international expansion, strategic partnerships, and new product launches.

Cybersecurity Specialist

As fintech companies handle sensitive financial data and transactions, cybersecurity specialists play a critical role in protecting against cyber threats and ensuring the security of the company's systems and infrastructure. Cybersecurity specialists are responsible for developing and implementing security policies, conducting risk assessments, and monitoring for and responding to security incidents. Salaries for cybersecurity specialists in fintech can range from $5,000 to $10,000 per month, depending on the size and complexity of the company and the specific skills and certifications of the individual. Companies like Grab, Wise, and Nium are actively seeking cybersecurity specialists to work on projects such as penetration testing, vulnerability management, and incident response.

User Experience (UX) Designer

User experience designers in the fintech industry are responsible for creating intuitive and engaging user interfaces that help customers navigate and interact with financial products and services. They work closely with product managers, developers, and stakeholders to design and test user interfaces that meet the needs of customers and align with the company's business objectives. Salaries for UX designers in fintech can range from $4,500 to $10,000 per month, depending on the size and complexity of the company and the specific skills and experience of the individual. Companies like Grab, Wise, and Aspire are actively seeking UX designers to work on projects such as mobile app design, web interface design, and user testing.

Fintech Analyst

Fintech analysts are responsible for conducting market research, analyzing industry trends, and providing insights and recommendations to help companies make informed business decisions. They work closely with product managers, business development managers, and executives to identify opportunities and challenges in the fintech industry and develop strategies to address them. Salaries for fintech analysts can range from $4,000 to $8,000 per month, depending on the size and complexity of the company and the specific skills and experience of the individual. Companies like Grab, Wise, and Nium are actively seeking fintech analysts to work on projects such as competitive analysis, market forecasting, and strategic planning.

The Fintech Industry in Singapore

Singapore has emerged as a global leader in the fintech industry, thanks to its strategic location, robust regulatory framework, and progressive governmental policies. The city-state is home to over 1,000 fintech companies, ranging from startups to established financial institutions, and is a hub for innovation in areas such as digital payments, blockchain, and regtech.

The fintech industry in Singapore is rapidly growing, with significant developments expected in digital assets and payment markets. According to Statista, the digital assets market in Singapore is expected to reach an AUM of US$405.2M in 2023, with a revenue growth of 33.5% in 2024, indicating increasing financial involvement in digital assets. By 2027, the number of users in the digital payments market is estimated to reach 4.5 million users, indicating a growing preference for cashless transactions.

The Monetary Authority of Singapore (MAS) has played a key role in fostering the growth of the fintech industry, implementing regulatory changes to address consumer security and fraud concerns in line with technological advancements. MAS is also collaborating with other central banks on projects related to digital money and cross-border transactions, including Project Mandala and stablecoin regulation.

Singapore Fintech Job Salaries (Monthly in SGD)

Top Fintech Companies in Singapore

Singapore is home to a diverse range of fintech companies, each offering unique products and services that cater to the needs of consumers and businesses. Here are some of the top fintech companies in Singapore:

Grab is a transportation turned financial services company that went public in 2021 with a valuation of $39.6B. The company offers a wide range of fintech products and services, including mobile wallets, digital payments, and lending solutions. Grab is actively hiring for a variety of fintech roles, including data scientists, product managers, and business development managers.

Wise, formerly known as TransferWise, is a money transfer fintech company that secured a spot in the top 5 for Singapore's best places to work in 2022. The company offers international money transfer services and multi-currency accounts, and is actively hiring for compliance and other fintech roles in Singapore.

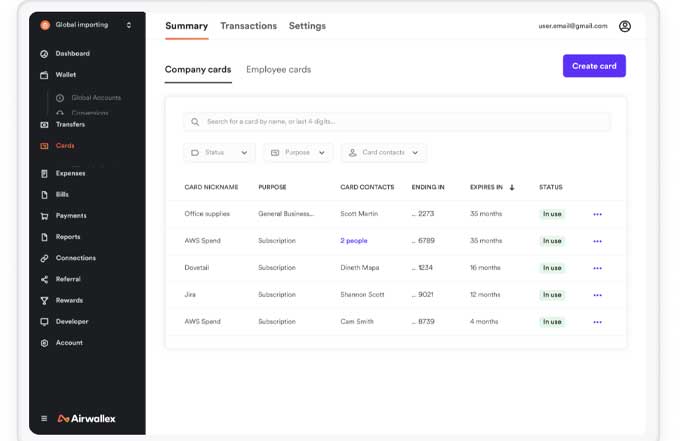

Airwallex is a B2B fintech company that has emerged as a unicorn, with a valuation of over $1 billion. The company offers international payments, foreign exchange, and business accounts, and is actively hiring software engineers, data scientists, and business development managers in Singapore.

Nium is a B2B fintech company that offers cross-border payments, card issuance, and banking-as-a-service solutions. The company attained unicorn status in 2021 and is actively hiring for a variety of fintech roles, including compliance officers, product managers, and fintech analysts.

Aspire is a B2B fintech company that serves over 15,000 small-medium enterprises across South East Asia and the Asia Pacific region, offering corporate credit cards, multi-currency business accounts, and expense management services. The company has experienced significant growth, with $15 billion of annualized total payment volumes.

Fintech Industry Market

The fintech industry in Singapore is a rapidly growing market, with significant opportunities for growth and innovation. According to Statista, the digital payments market in Singapore is expected to reach $10.07 billion in revenue by 2024, with a user penetration rate of 67.1%. The digital assets market is also expected to grow, reaching an AUM of US$405.2M in 2023 and generating a revenue growth of 33.5% in 2024.

The Monetary Authority of Singapore (MAS) has played a key role in fostering the growth of the fintech industry, implementing regulatory changes to address consumer security and fraud concerns in line with technological advancements. MAS has also established real-time cross-border payment connections with neighboring countries and participated in international initiatives like Project Nexus.

Despite decreased venture capital funding, Singapore remains a leader in the fintech industry, hosting over 700 fintech companies in areas such as payments, blockchain, and regtech. The country has also established the Singapore Financial Data Exchange, a public digital infrastructure that allows individuals to securely access their financial data from multiple agencies through a single access point.

Conclusion

Singapore's fintech industry offers a wide range of exciting and lucrative career opportunities, from software engineering to compliance and beyond. As the industry continues to grow and evolve, the demand for skilled professionals in fintech is expected to remain strong. Companies like Grab, Wise, Airwallex, Nium, and Aspire are actively hiring for a variety of fintech roles, offering competitive salaries and the opportunity to work on cutting-edge projects that are shaping the future of finance.

For those looking to break into the fintech industry in Singapore, it's important to stay up-to-date with the latest industry trends and developments, and to continuously develop your skills and expertise. Whether you're a software engineer, data scientist, product manager, or compliance officer, there are plenty of opportunities to grow and succeed in the dynamic and fast-paced world of fintech in Singapore.