What are the critical elements that every fintech founder should consider when scaling their business to achieve sustainable growth and long-term success? Scaling a fintech business is a multifaceted endeavor that requires careful planning, strategic execution, and a deep understanding of both the financial industry and technological innovation. As the fintech sector continues to disrupt traditional financial services, founders are presented with immense opportunities and challenges in equal measure.

Understanding the Fintech Landscape

The Rise of Fintech

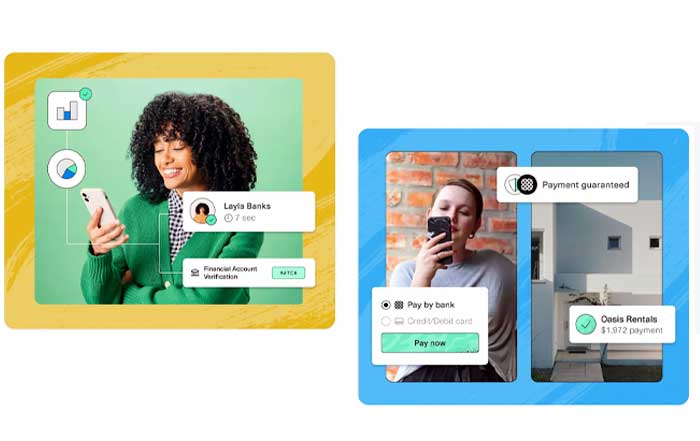

The fintech industry has experienced exponential growth over the past decade, fundamentally transforming how consumers and businesses interact with financial services. Innovations in mobile payments, blockchain technology, and digital banking have lowered barriers to entry and fostered a competitive environment where agility and customer-centric solutions reign supreme.

Fintech companies like Stripe and Revolut have set new standards in payment processing and digital banking, demonstrating the potential for rapid growth and global reach. Understanding the factors that have contributed to the success of such companies is essential for founders aiming to scale their own ventures.

Key Challenges in Fintech

Despite the promising landscape, fintech founders face unique challenges that can impede scaling efforts. Regulatory compliance, cybersecurity threats, and the need for continuous innovation are significant hurdles. Additionally, the competitive nature of the industry means that customer acquisition and retention require more sophisticated strategies.

Building a Scalable Business Model

Importance of Scalability

A scalable business model is the foundation upon which growth is built. It allows a company to increase revenue without a corresponding rise in operational costs. For fintech founders, scalability ensures that the business can handle increased transaction volumes, customer inquiries, and market expansion without compromising on service quality or profitability.

Designing for Growth

Designing a business model with scalability in mind involves:

Modular Architecture: Implementing a system where components can be added or removed without affecting the whole.

Cloud Infrastructure: Leveraging cloud services to provide flexibility and scalability in computing resources.

API Integration: Utilizing APIs to integrate with other services and platforms, enhancing functionality and reach.

Companies like Plaid exemplify the power of API integration in scaling operations and expanding service offerings.

Regulatory Compliance and Legal Considerations

Navigating Financial Regulations

The financial industry is heavily regulated to protect consumers and maintain market integrity. Fintech founders must navigate a complex web of regulations that vary by country and region. Non-compliance can result in severe penalties and damage to the company's reputation.

Ensuring Compliance at Scale

Scaling a fintech business amplifies regulatory challenges. Founders should:

Invest in Legal Expertise: Hiring legal professionals who specialize in financial regulations can provide valuable guidance.

Implement Compliance Programs: Establishing robust compliance frameworks that evolve with the company's growth.

Engage with Regulators: Building relationships with regulatory bodies can facilitate smoother operations and proactive compliance.

Leveraging Technology for Scalability

Cloud Computing and Infrastructure

Cloud computing offers scalable solutions that can adjust to the company's needs in real-time. Services like Amazon Web Services and Microsoft Azure provide infrastructure that supports growth without the need for significant upfront investment in hardware.

Automation and AI

Automation reduces manual processes, increases efficiency, and minimizes errors. Implementing artificial intelligence can enhance customer service through chatbots and predictive analytics, providing personalized experiences at scale.

Funding and Investment Strategies

Attracting Investors

Securing funding is critical for scaling. Fintech founders should:

Develop a Compelling Pitch: Clearly articulate the value proposition and growth potential.

Demonstrate Traction: Show evidence of market demand and successful pilot programs.

Highlight Scalability: Emphasize how the business model is designed for growth.

Managing Financial Resources

Efficient financial management ensures that capital is allocated to areas that drive growth. Implementing rigorous budgeting and forecasting practices can prevent overspending and ensure sustainability.

Fintech Scaling Roadmap

1. Understand the Landscape

Analyze fintech market, identify opportunities, understand regulatory environment

2. Build Scalable Business Model

Design modular architecture, leverage cloud infrastructure, integrate APIs

3. Ensure Regulatory Compliance

Invest in legal expertise, implement robust compliance programs

4. Leverage Technology

Utilize cloud computing, implement AI and automation solutions

5. Secure Funding

Develop compelling pitch, demonstrate market traction, highlight scalability

6. Build Strong Team

Hire for cultural fit, develop diverse skills, encourage continuous learning

7. Customer Strategy

Implement digital marketing, develop referral programs, excel in customer service

8. Risk Management

Conduct regular audits, obtain appropriate insurance, develop crisis management plans

Talent Acquisition and Team Building

Building a Skilled Team

A company's success is heavily reliant on the expertise and dedication of its team. Founders should focus on:

Hiring for Cultural Fit: Employees who align with the company's values are more likely to contribute positively.

Diverse Skill Sets: Building a team with varied backgrounds fosters innovation and problem-solving.

Continuous Learning: Encouraging professional development keeps the team at the forefront of industry advancements.

Maintaining Company Culture

As the company grows, preserving the founding culture becomes challenging. Implementing clear communication channels, promoting transparency, and recognizing employee contributions can maintain a positive work environment.

Customer Acquisition and Retention

Marketing Strategies

Effective marketing is essential for attracting new customers. Strategies include:

Digital Marketing: Utilizing SEO, content marketing, and social media to reach target audiences.

Partnerships: Collaborating with established companies to access their customer base.

Referral Programs: Encouraging existing customers to refer others through incentives.

Customer Service Excellence

Retaining customers is as important as acquiring new ones. Providing exceptional customer service builds loyalty and generates positive word-of-mouth referrals.

Risk Management

Identifying Risks

Scaling introduces new risks, including operational, financial, and reputational. Founders must proactively identify potential issues that could derail growth.

Mitigation Strategies

Implementing risk management strategies involves:

Regular Audits: Conducting internal and external audits to uncover vulnerabilities.

Insurance: Obtaining appropriate coverage to protect against unforeseen events.

Crisis Management Plans: Preparing response strategies for potential crises.

Strategic Partnerships and Collaborations

Benefits of Partnerships

Forming strategic partnerships can accelerate growth by leveraging the strengths of other organizations. Benefits include:

Expanded Reach: Accessing new markets and customer segments.

Resource Sharing: Utilizing shared technology and expertise.

Enhanced Credibility: Associating with reputable partners can build trust with customers.

Choosing the Right Partners

Selecting partners requires careful consideration. Factors include:

Alignment of Goals: Ensuring both parties have compatible objectives.

Cultural Fit: Similar corporate cultures facilitate smoother collaboration.

Mutual Benefit: Partnerships should provide value to all involved entities.

Global Expansion

Understanding International Markets

Expanding globally presents opportunities for growth but also introduces complexities. Founders must understand:

Cultural Differences: Adapting products and services to meet local preferences.

Regulatory Environments: Complying with international laws and regulations.

Market Dynamics: Analyzing competition and demand in new regions.

Localization Strategies

Successful global expansion often requires localization, including:

Language Adaptation: Offering services in local languages.

Currency Support: Facilitating transactions in local currencies.

Tailored Marketing: Developing marketing campaigns that resonate with local audiences.

Measuring Success

Key Performance Indicators (KPIs)

Establishing KPIs allows founders to track progress and make data-driven decisions. Important KPIs for fintech include:

Customer Acquisition Cost (CAC): The cost associated with acquiring a new customer.

Lifetime Value (LTV): The total revenue expected from a customer over the duration of their relationship with the company.

Churn Rate: The rate at which customers stop using the service.

Continuous Improvement

Scaling is not a one-time effort but an ongoing process. Regularly reviewing performance metrics and seeking feedback can identify areas for improvement and innovation.

Get Your Startup into Growth!

Scaling a fintech business is a complex journey that demands strategic foresight, adaptability, and a relentless focus on delivering value to customers. By understanding the intricacies of the fintech landscape, building a scalable business model, navigating regulatory challenges, leveraging technology, and cultivating strong teams and partnerships, founders can position their companies for sustained growth and success in the dynamic world of financial technology.