The fintech industry in Japan has evolved rapidly over the past decade, aligning itself with the global surge in digital financial solutions. Japanese corporations have embraced fintech innovations to meet the demands of increasingly tech-savvy consumers and businesses. As a result, the Japanese fintech industry now offers a wide array of high-paying jobs across various disciplines, each playing a critical role in driving the growth and competitiveness of the sector. Below is a detailed exploration of some of the major corporate fintech jobs in Japan, including their job descriptions, pay ranges, company products and services and industry market insights.

1. Chief Technology Officer (CTO) - Fintech

The Chief Technology Officer in a fintech company is responsible for leading the company's technological strategy, ensuring that it remains competitive in a fast-paced industry. This role involves overseeing the development and implementation of software solutions, digital payment systems, and cybersecurity frameworks. The CTO collaborates with other executives to align the company’s technology roadmaps with its overall business goals, while ensuring compliance with local regulations like Japan’s Financial Services Agency (FSA) guidelines.

The CTO in a fintech firm typically earns between ¥20 million and ¥35 million annually, depending on the size of the company and its market presence. Major fintech firms in Japan, such as Rakuten and LINE Pay, often provide additional stock options and performance bonuses, reflecting the significance of the role in maintaining a competitive edge in the industry.

In terms of products and services, companies like Rakuten specialize in e-commerce and digital banking, offering a broad range of services from credit cards to online payment solutions. LINE Pay, another major player, offers mobile payment platforms and digital wallets, making the CTO's role crucial in managing large-scale fintech systems that handle millions of daily transactions.

2. Head of Compliance and Risk Management

Japan’s fintech sector, like its global counterparts, faces stringent regulatory requirements. The Head of Compliance and Risk Management ensures that the fintech company adheres to these regulations, protecting it from legal issues, financial penalties, and reputational damage. This role involves conducting regular audits, liaising with regulatory bodies, and implementing risk management strategies to safeguard the company’s financial transactions and data.

The salary range for this position is typically between ¥15 million and ¥25 million per year, depending on the complexity of the company's operations. Financial services companies like SBI Holdings and Monex Group, both of which offer brokerage services and digital banking, often require robust compliance frameworks to ensure they remain compliant with the Japanese FSA, as well as global regulatory bodies, when operating internationally.

The industry market in Japan is complex, as fintech firms must navigate a blend of traditional financial regulations and emerging guidelines for digital currencies, blockchain technologies, and electronic payment systems. Therefore, the role of a Head of Compliance is paramount in mitigating legal risks while supporting the company’s rapid growth in a highly competitive market.

3. Product Manager - Digital Banking

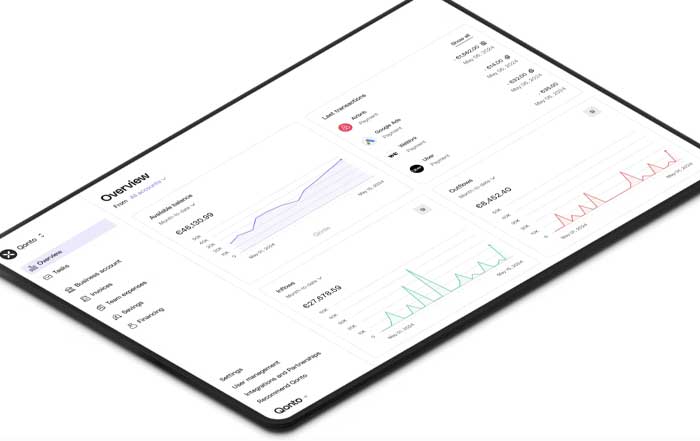

Product Managers in digital banking fintech companies in Japan are responsible for developing and refining financial products such as mobile banking apps, online loan platforms, and digital payment services. This role involves working closely with software developers, UX/UI designers, marketing teams, and financial analysts to create products that meet the needs of both retail and corporate clients.

Product Managers in fintech companies typically earn between ¥10 million and ¥18 million per year, with additional incentives tied to the success of their products. Japanese fintech companies like Jibun Bank and Kyash focus on digital banking services that cater to the tech-savvy younger generation. These companies are constantly innovating, launching new services such as peer-to-peer lending, digital wallets, and credit scoring systems, making the role of the Product Manager integral to their growth.

In Japan, the digital banking sector is expanding, with more consumers shifting to online banking services and away from traditional brick-and-mortar institutions. Product Managers in this field are tasked with continuously evolving their offerings to capture market share in an increasingly competitive landscape.

4. Data Scientist - Fintech

Data scientists are among the most sought-after professionals in the Japanese fintech industry. Their primary role is to analyze large datasets to identify trends, improve product offerings, and enhance customer experiences. Data scientists work closely with product managers, marketing teams, and senior leadership to develop algorithms that can predict customer behavior, optimize risk assessments, and detect fraudulent activities.

The pay range for a data scientist in fintech varies from ¥8 million to ¥15 million per year, depending on experience and the size of the company. Companies like Paidy, a buy-now-pay-later service, rely heavily on data scientists to refine their credit scoring algorithms, ensuring that they can offer loans to consumers with minimal risk.

In terms of market impact, data scientists in Japan’s fintech industry are crucial for companies seeking to leverage artificial intelligence and machine learning. The ability to process vast amounts of financial data quickly and accurately enables fintech firms to offer personalized services, optimize loan approvals, and develop innovative products that stand out in a crowded market.

5. Blockchain Engineer

Blockchain technology is one of the most disruptive forces in fintech, and Japan is no exception. Blockchain Engineers are responsible for developing decentralized applications (dApps), creating smart contracts, and implementing secure and scalable blockchain infrastructure. These engineers work on projects that range from cryptocurrency exchanges to blockchain-based financial platforms.

The salary for a blockchain engineer in Japan typically ranges from ¥12 million to ¥20 million annually, with potential bonuses tied to project milestones and success. Companies like bitFlyer and Coincheck, which are major players in Japan’s cryptocurrency market, employ blockchain engineers to maintain their trading platforms, ensure security, and develop new blockchain-based services.

Blockchain engineers are particularly in demand as Japan’s cryptocurrency market continues to grow, with a focus on developing secure, efficient, and transparent financial systems. The regulatory environment in Japan is relatively favorable towards cryptocurrencies, making blockchain engineering a key area of focus for fintech companies seeking to expand their offerings.

Corporate Fintech Jobs in Japan: Salary Ranges

6. UX/UI Designer - Fintech Platforms

User experience (UX) and user interface (UI) designers play a critical role in Japan’s fintech sector by ensuring that digital platforms are intuitive, user-friendly, and accessible. They are responsible for designing mobile apps, websites, and other digital interfaces that consumers use to access financial services, ensuring that these platforms are both aesthetically pleasing and functional.

UX/UI Designers in fintech firms typically earn between ¥6 million and ¥12 million per year. Companies like Money Forward, which provides personal financial management software, and Zaim, a popular household budget management app, heavily rely on UX/UI designers to differentiate their services from competitors.

The fintech market in Japan is highly competitive, with companies constantly developing new products to appeal to both tech-savvy millennials and more conservative older generations. UX/UI designers must balance simplicity with functionality to meet the needs of a diverse user base, making their role essential in driving customer satisfaction and retention.

7. Artificial Intelligence (AI) Engineer

AI Engineers are responsible for designing and implementing machine learning models that enhance financial products and services. In Japan, AI is being used to automate processes such as customer service via chatbots, fraud detection, and personalized investment advice. AI Engineers work closely with data scientists and software developers to create algorithms that optimize financial processes and improve user experiences.

The annual salary for an AI Engineer in Japan’s fintech industry ranges from ¥10 million to ¥18 million, depending on the level of experience and the scope of the projects they manage. Companies such as WealthNavi, which provides automated investment services, use AI to offer robo-advisors that tailor investment portfolios based on individual risk profiles.

AI is becoming a critical component in Japan’s fintech landscape, particularly in areas like digital wealth management and fraud prevention. The ability of AI engineers to create intelligent, data-driven solutions is increasingly central to the success of fintech companies in the country.

8. Cybersecurity Specialist

As the fintech industry in Japan grows, so does the need for robust cybersecurity measures. Cybersecurity Specialists are tasked with ensuring that all digital platforms are secure from potential cyberattacks, data breaches, and fraudulent activities. They work closely with IT teams to implement encryption protocols, secure APIs, and compliance with industry standards such as the Payment Card Industry Data Security Standard (PCI DSS).

Cybersecurity specialists in the fintech industry in Japan typically earn between ¥8 million and ¥14 million per year. Firms like PayPay, a leading mobile payment platform, prioritize cybersecurity to protect the sensitive financial data of millions of users. Similarly, other companies in the payments and lending sectors rely on cybersecurity experts to build trust with customers and partners.

Given the increasing threat of cybercrime, the demand for cybersecurity specialists in Japan’s fintech sector is expected to continue rising. Their work is critical in maintaining the integrity of financial systems and ensuring that consumers and businesses feel secure when using digital financial services.

9. Fintech Marketing Manager

Marketing managers in fintech companies are responsible for promoting products and services to both retail consumers and corporate clients. They work on brand strategy, digital marketing campaigns, customer acquisition strategies, and product launches. Marketing managers must have a deep understanding of the fintech landscape, enabling them to differentiate their company’s offerings in a crowded market.

Marketing managers in fintech firms typically earn between ¥9 million and ¥16 million per year, depending on the scale of their marketing efforts. Companies like Paytm and Rakuten heavily invest in marketing to promote their digital wallets, credit card services, and e-commerce platforms. These companies focus on user growth, making the role of a marketing manager central to their overall strategy.

The fintech market in Japan is marked by a high level of competition, particularly in areas like digital payments and peer-to-peer lending. As a result, marketing managers must be creative, data-driven, and well-versed in digital marketing trends to successfully promote their products and maintain customer loyalty.

10. Cloud Engineer - Financial Services

Cloud Engineers are responsible for managing the infrastructure of fintech companies, ensuring that all digital services run smoothly and securely on cloud platforms. In Japan, cloud engineers work with services like AWS, Microsoft Azure, and Google Cloud to build scalable financial products that can handle millions of transactions simultaneously.

Cloud Engineers in the fintech industry earn between ¥10 million and ¥18 million annually, with bonuses tied to the performance of the company’s cloud infrastructure. Fintech companies such as Freee and Moneytree use cloud services to offer accounting software and financial management solutions for both businesses and consumers, making cloud engineers an integral part of their operations.

As more fintech companies move to cloud-based solutions to reduce costs and improve scalability, the demand for skilled cloud engineers is increasing. This role is crucial in ensuring that financial services are available 24/7, without interruptions, while maintaining high levels of security and data protection.

Wrap Up

The corporate fintech job market in Japan offers diverse, high-paying roles that contribute to the rapid growth and innovation in the financial technology sector. From leadership positions like CTOs to technical roles like AI engineers and blockchain specialists, each job plays a vital role in driving the industry forward. With the fintech sector poised for continued expansion, these roles will not only offer lucrative careers but also shape the future of finance in Japan and beyond.