Artificial intelligence (AI) has revolutionized numerous sectors across the globe, but few industries have experienced its transformative power as profoundly as financial technology, or fintech. The advent of AI in fintech has not only streamlined complex processes but has also enhanced accuracy, efficiency, and security in ways that were previously unimaginable. As the global financial landscape grows increasingly intricate, the use of AI-driven solutions is allowing businesses and consumers to navigate this complexity with greater ease, providing a wealth of opportunities for innovation, disruption, and growth. The following analysis delves into the multifaceted roles of AI in fintech, examining its application across various subfields, the benefits it offers, the challenges it presents, and its potential to shape the future of finance.

AI’s Role in Fraud Detection and Prevention

One of the most significant applications of AI in fintech lies in fraud detection and prevention. In today’s digital financial ecosystem, fraud has become a critical concern for businesses and consumers alike. With billions of transactions occurring across the globe every day, traditional fraud detection methods often prove inadequate due to their inability to scale and adapt to new types of fraudulent activity. This is where AI steps in, using sophisticated machine learning algorithms to analyze vast amounts of transactional data in real-time.

AI systems can identify patterns and anomalies that might indicate fraudulent behavior. Unlike rule-based systems, which rely on predefined criteria, AI models are dynamic and can learn from new data, allowing them to evolve alongside emerging fraud tactics. AI tools continuously refine their detection capabilities, improving the accuracy of identifying fraudulent activities. By leveraging deep learning and neural networks, AI can pinpoint even the subtlest deviations from normal behavior, such as minute irregularities in spending habits or atypical transaction locations. This allows financial institutions to mitigate risks before they escalate, protecting customers from fraud and reducing losses for businesses.

Moreover, AI can enhance the user experience by minimizing the number of false positives—situations where legitimate transactions are flagged as suspicious. By reducing these unnecessary disruptions, AI-driven fraud detection systems ensure smoother and more reliable customer interactions with financial services, reinforcing trust in fintech platforms.

Enhancing Customer Service Through AI-Driven Chatbots

Customer service is another area where AI has made a significant impact in fintech. The use of AI-powered chatbots has revolutionized how financial institutions interact with their customers, providing personalized assistance around the clock without the need for human intervention. These chatbots are capable of handling a wide range of customer queries, from basic account information requests to more complex financial inquiries, all while learning and improving over time through natural language processing (NLP).

Chatbots are not only cost-effective but also highly efficient in resolving common customer issues, significantly reducing the burden on human support staff. AI chatbots use sophisticated algorithms to process customer inputs, understand the context, and respond with appropriate solutions. They are designed to mimic human conversation, offering a more personalized experience compared to traditional automated systems. In many cases, chatbots are able to provide immediate assistance, minimizing wait times and enhancing customer satisfaction.

Beyond answering questions and addressing concerns, chatbots can guide users through various financial processes, such as loan applications, investment decisions, or insurance claims. AI-powered virtual assistants are also increasingly being used to help customers manage their finances, offering personalized budgeting advice, notifying them of upcoming payments, and even making recommendations based on spending patterns. As AI chatbots continue to evolve, they are likely to become even more integral to the customer service strategies of fintech companies, ensuring that customers receive timely and relevant support.

AI and Algorithmic Trading

One of the most disruptive applications of AI in fintech is in the realm of algorithmic trading. Traditionally, stock trading was dominated by large institutional investors and required a deep understanding of the market, intricate strategies, and considerable capital. However, the introduction of AI has democratized the trading landscape, allowing retail investors and smaller firms to participate on a more level playing field. Algorithmic trading uses AI to analyze vast datasets, assess market conditions, and execute trades at high speeds and frequencies that are impossible for human traders to achieve.

AI-powered trading algorithms can process news, social media trends, economic reports, and historical data to predict stock price movements with remarkable accuracy. These algorithms can execute trades in milliseconds, allowing investors to capitalize on even the smallest market fluctuations. Moreover, AI-driven trading systems can operate around the clock, ensuring that trades are made based on optimal conditions regardless of the time of day or the geographical market.

Additionally, AI can help to mitigate risk by dynamically adjusting trading strategies in response to market volatility. By analyzing real-time data, AI systems can identify potential market disruptions and adjust positions accordingly, reducing the likelihood of significant losses. AI’s ability to process and analyze complex datasets far surpasses human capabilities, and as these systems continue to improve, they are likely to play an even more dominant role in the financial markets.

The Impact of AI on Credit Scoring and Lending

AI’s influence in fintech extends to credit scoring and lending processes, where it is driving more accurate assessments and fairer access to credit. Traditional credit scoring models rely heavily on historical data, such as past borrowing behavior, employment history, and credit utilization. These models often exclude individuals with little or no credit history, leaving many people, particularly those in underserved communities, without access to credit.

AI-driven credit scoring models take a more comprehensive approach by considering alternative data points, such as social media activity, utility payments, and online behavior. This allows financial institutions to assess the creditworthiness of individuals who would otherwise be deemed ineligible under traditional models. AI algorithms analyze these non-traditional data points to create a more nuanced picture of an individual’s financial health, enabling more accurate lending decisions and expanding access to credit for a wider range of consumers.

In addition to improving credit accessibility, AI is also enhancing the efficiency of lending processes. Automated systems powered by AI can process loan applications faster and more accurately than human agents, reducing the time it takes to approve and disburse loans. This is particularly valuable for small businesses and consumers seeking quick access to funds. Furthermore, AI systems can continuously monitor borrower behavior throughout the loan term, providing early warning signals for potential defaults and allowing lenders to take proactive measures.

AI in Financial Planning and Wealth Management

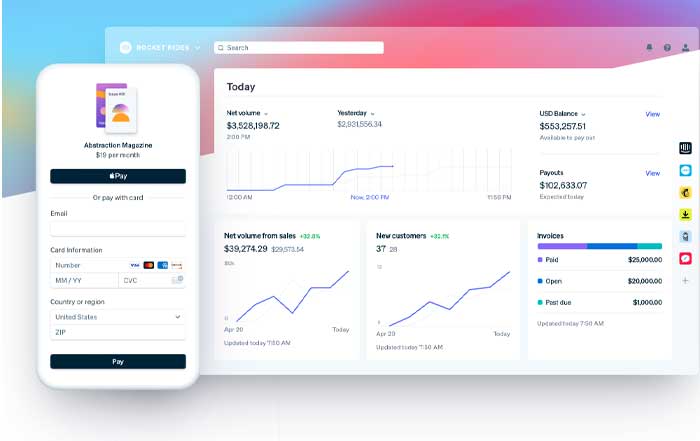

The use of AI in financial planning and wealth management has given rise to the concept of robo-advisors—automated platforms that provide financial advice and investment management services based on algorithms. These AI-driven systems analyze a client’s financial situation, goals, and risk tolerance to create tailored investment strategies. Robo-advisors have democratized wealth management, making it accessible to individuals who may not have the means to afford traditional financial advisors.

AI-driven wealth management platforms are designed to be intuitive and user-friendly, allowing clients to input their financial goals and preferences, after which the system generates a personalized investment portfolio. The use of AI in this space has led to lower fees compared to traditional advisory services, making wealth management more affordable for the average investor.

Furthermore, AI can help optimize investment strategies by continuously analyzing market conditions and making adjustments to portfolios in real-time. Machine learning models can identify trends and predict future market movements, enabling investors to maximize returns while minimizing risk. Robo-advisors also offer the benefit of 24/7 monitoring, ensuring that investment portfolios are managed efficiently even outside of traditional market hours. As AI continues to evolve, it is likely that robo-advisors will become even more sophisticated, offering clients more personalized and advanced financial advice.

Regulatory Compliance and Risk Management

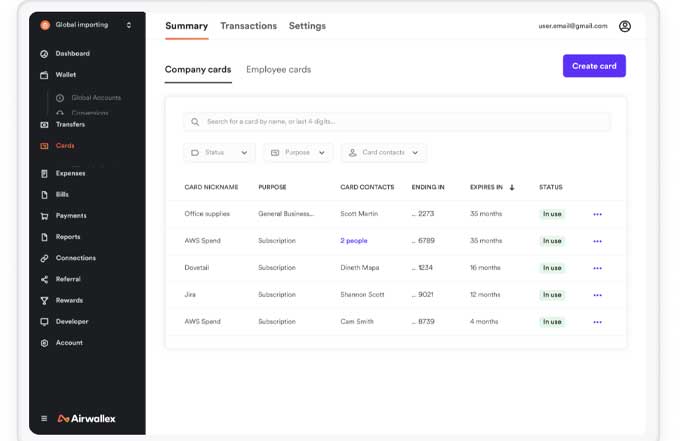

Regulatory compliance is a critical aspect of the financial services industry, and AI is playing an increasingly important role in helping fintech companies navigate the complex and ever-changing regulatory landscape. The use of AI in regulatory technology, or regtech, has revolutionized how financial institutions manage compliance with regulations, such as anti-money laundering (AML) and know-your-customer (KYC) requirements.

AI-powered compliance systems can process vast amounts of regulatory data, analyzing changes in laws and regulations to ensure that financial institutions remain compliant. These systems can automatically update compliance frameworks in response to new regulations, reducing the risk of non-compliance and the potential for costly fines.

In addition to regulatory compliance, AI is also being used for risk management. AI algorithms can analyze market data, historical trends, and geopolitical factors to predict potential risks that could impact a financial institution’s operations. This allows fintech companies to make informed decisions and mitigate risks before they materialize. By leveraging AI for risk management, fintech firms can ensure greater stability and security for their customers and shareholders.

The Challenges of AI in Fintech

While the benefits of AI in fintech are undeniable, the technology is not without its challenges. One of the primary concerns is data privacy. AI systems rely heavily on vast amounts of data, including sensitive personal and financial information. This raises concerns about how this data is collected, stored, and used. Financial institutions must ensure that their AI systems are secure and compliant with data protection regulations, such as the General Data Protection Regulation (GDPR) in the European Union.

Moreover, the black-box nature of AI algorithms can make it difficult for regulators and financial institutions to understand how certain decisions are made. This lack of transparency can lead to concerns about bias, particularly in areas such as credit scoring and lending. If AI algorithms are trained on biased data, they may inadvertently perpetuate discriminatory practices. As such, there is a growing demand for explainable AI—systems that can provide clear and understandable explanations for their decisions.

Another challenge is the potential displacement of jobs. As AI systems become more prevalent in the financial industry, there is concern that they will replace human workers, particularly in roles such as customer service, fraud detection, and investment management. While AI can enhance efficiency, it is important for the industry to strike a balance between automation and human oversight to ensure that jobs are not lost and that the human touch remains in customer interactions.

The Future of AI in Fintech

The future of AI in fintech is promising, with new developments and innovations expected to continue transforming the industry. As AI technology advances, we are likely to see even more sophisticated applications in areas such as financial forecasting, personalized banking, and blockchain technology. AI-driven solutions will become more seamless, intuitive, and integrated into everyday financial services, offering consumers and businesses alike new levels of convenience, efficiency, and security.

In the realm of personalized banking, AI is expected to play a key role in delivering hyper-personalized financial services, such as tailored investment portfolios, customized loan options, and individualized spending insights. This level of personalization will allow financial institutions to meet the unique needs of their customers more effectively, fostering stronger relationships and customer loyalty.

Blockchain technology, combined with AI, has the potential to revolutionize areas such as payments, identity verification, and smart contracts. AI can enhance the security and scalability of blockchain networks, while blockchain’s decentralized nature can provide greater transparency and trust in AI-driven systems.

In conclusion, the use of AI in fintech is reshaping the financial landscape in profound ways. From fraud detection to algorithmic trading, customer service to credit scoring, AI is enabling financial institutions to operate more efficiently, securely, and intelligently. While challenges remain, the potential for AI to drive innovation in fintech is vast, and as the technology continues to evolve, it will undoubtedly unlock new opportunities for growth, disruption, and transformation in the financial sector.